One of the mysteries in the modern day world is the price of crude oil. Nobody really knows why the price of oil varies on a daily basis and why prices continue to go up. So it is not surprising that even the U.S. government’s Energy Information Administration states the following on its website: “The world oil market is complicated”. In this post lets take a quick look at this “complicated” market.

The two types of companies that dominate the world oil market are the International Oil Companies known as IOCs and the National Oil Companies called as NOCs. The IOCs are private companies while the NOCs are owned by governments. The NOCs control the majority of the world’s proven reserves and produced at least 55% of the world’s output in 2010. An example of IOC is Exxon Mobil and an example of NOC is Pemex of Mexico.

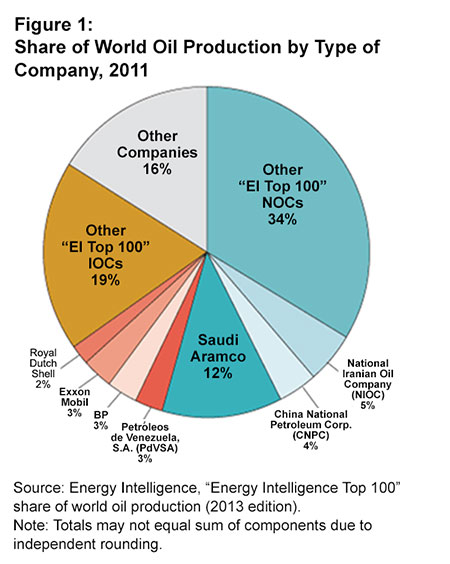

The following chart shows the share of the world’s oil production by type of company in 2011:

Click to enlarge

Source: Who are the major players supplying the world oil market?, U.S. EIA

The U.S. has no NOCs. The entire oil market from exploration to production to distribution is in the hands of private companies who determine the price that the public pays at the pump. Some of these US-based IOCs include ExxonMobil (XOM), Chevron (CVX) and ConocoPhillips(COP). As these companies are private, they are only answerable to their shareholders and not the U.S. government. The U.S. government cannot set the price of gasoline or interfere in the workings of these companies. Hence consumers are the mercy of these giant corporations when they fill gasoline for their cars and other vehicles. As these companies are responsible only to their shareholders who demand ever-higher returns and not to consumers or the government, price gouging at the pump occurs 24 hours a day on every day of the year right under the nose of the state.

The top three international oil companies by production in 2012 were Exxon Mobil, BP (BP), and Royal Dutch Shell (RDS-A, RDS-B). The top three NOCs based on production were Saudi Aramco, National Iranian Oil Company (NIOC) and PdVSA of Venezuela .

The majority of the NOCs such as Saudi Aramco (Saudi Arabia), Pemex (Mexico), and PdVSA (Venezuela) are directly owned and operated as an extension of the government. All NOCs of the OPEC fall into this category. The goal of these NOCs is mainly to provide subsidized oil to the domestic consumers and generate revenue for the national governments by selling oil in the international market at market prices. Theoretically the states are supposed to use the oil wealth to help advance the country’s economy. Hence price of gasoline tend be very cheap relative to world prices in countries with these type of NOCs. As the government sets the price of oil in these countries, the price of gasoline does not vary based on the international market prices.

The second type of NOC are the ones which do not operate as an agency of the government but operate as a corporate entity. They try to satisfy both the profit-motives of a private corporation and further the goals of the country. The state may hold a major stake in these companies in order to have some control over how they are run. Statoil (STO) of Norway and Petrobras (PBR) of Brazil are example of such as NOCs.

OPEC:

Organization of the Petroleum Exporting Countries (OPEC) is a group of some of the the world’s most oil-rich countries. They control about 70% of the world’s proven oil reserves. In its simplest form the OPEC can be considered as a cartel. Though the formation of cartels is illegal in most countries in all industries, the OPEC has been allowed to form and operate as a cartel. The OPEC controls the production, prices of oil and other matters related to oil. So just like any cartel, its job is to make sure that prices stay at a specific level to generate enough profits are determined by the member countries. So for example, if the price of oil falls because the world’s demand is down, the OPEC cuts production to bring up the price to the level it desires.

The 12 member of the OPEC are Iran, Iraq, Kuwait, Saudi Arabia, Qatar, United Arab Emirates, Algeria, Angola, Ecuador Libya, Nigeria and Venezuela. Ecuador and Venezuela are the only OPEC countries in the Western Hemisphere.

So one reason that can be attributed as to why the world’s oil market is complicated is that the OPEC cartel is allowed to exist to manipulate prices. One can only wonder why Western powers are unwilling to apply the the principles of free-market to the oil industry and force the dismantling of the OPEC.

Disclosure: No Positions