For most Americans the biggest purchase they will ever make in their life is a house. Next in this list of “necessities” of life in the U.S. is a car. Sadly both the purchases involve high transaction costs and consumers are the mercy of crooked salesmen and saleswomen who are more likely to put them in more debt than they have to. Last month fellow financial blogger and chief executive of FusionIQ Barry Ritholtz wrote about the ordeal of car buying process from a dealer.

The process of buying a house is also similar with too many players involved starting with the realtor. Unlike in other countries, home ownership is almost considered as a right and not a privilege. Until the credit crisis stuck, anyone – legal or illegal in the country and had a heartbeat – could get a mortgage to buy a house even with No Jobs, No Income and No Assets (NINJA) loans. Hence the U.S. has one of the highest home ownership in the world. Though technically most people that have mortgages don’t actually their homes, they are still considered as “owners”. In reality the banks that made the mortgage loan owns the property.

Most realtors and others will push the belief that buying a house is the best investment one will ever make. This because, they will state that with homes one can build equity and owing a home is cheaper than renting. They will also mention that one can even build wealth and use the house as an ATM by getting cash with home equity loans when housing prices soar. Nothing could be further from the truth. Today millions of “homeowners” own underwater homes – meaning they owe more on the property than the house is worth.

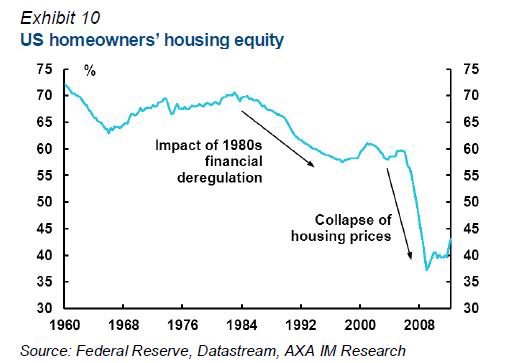

Here is a chart showing the disaster that building equity by homeowners since 1960:

Click to enlarge

Source: Investment Strategy, Special 2013 Outlook, AXA Investment Managers

From the AXA research report:

The housing market has finally bottomed out: prices, construction and sales are all on the rise. However, the legacy of the boom looms large over US homeowners. Until house prices went into reverse in 2006 the average US homeowner had a 60% equity stake in their home, now it is closer to 40%

(Exhibit 10). However, even this dramatic 20pp slide doesn’t reveal the full gory detail.

Related:

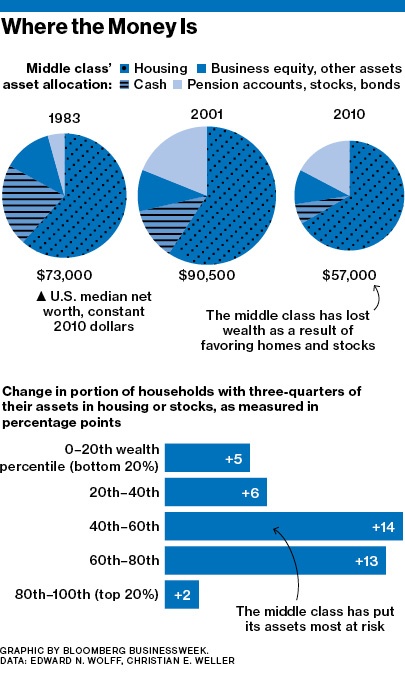

Click to enlarge

Source: U.S. Homeowners Are Repeating Their Mistakes. Bloomberg BusinessWeek, Feb 14, 2013