Companhia de Saneamento Basico do Estado de Sao Paulo also known as SABESP (SBS) was one of the top performing Brazilian ADRs in 2012.The ADR almost doubled last year. On Jan 24, 2013 the stock split 2 for 1.Before the split, each ADR was equal to two common shares. After the split, the ratio was changed to reflect one common share equal to one ADR.

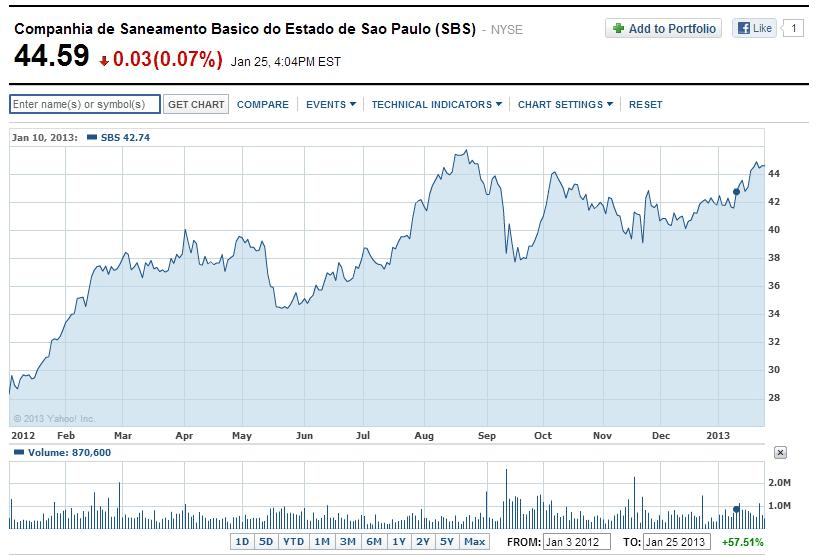

Here is the performance chart of SABESP ADR from Jan 3, 2012 thru Jan 25, 2013:

Click to enlarge

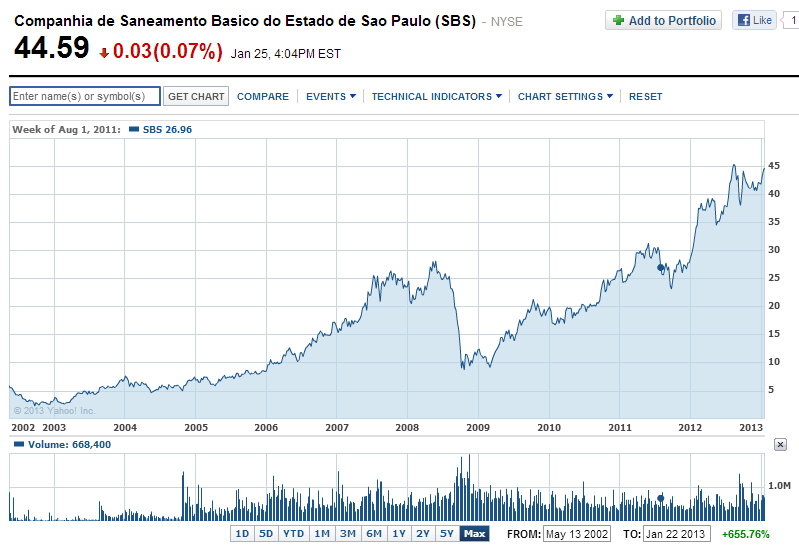

SABESP has had a strong run since 2002 as shown in the long-term chart below:

Source: Yahoo Finance

From about $56.00 at the start of 2012 the ADR jumped to $92.00 by August. At the time of stock split it reached a high of just above $90.00.

SABESP is a water and sewage services utility serving 363 municipalities in the Brazilian state of Sao Paulo. The state of Sao Paulo is the largest shareholder in the company. Revenues are for the most part consistent since most customers pay their bills on time. Unlike other services such as cell phone service providers selling voice, data and web services, this company offers one of the basic necessities of modern life. So from an investment point of view earnings are dependable.

Last year Brazil instituted regulations that adversely impacted the earnings of electric utilities. However Sabesp was not impacted since the company is a water and sewage utility. As investors realized this they bid up the stock prices leading to sharp rise in just a few months. This momentum may well lead the stock to perform better than other Brazilian utilities this year.

Currently the ADR has a 2.32% dividend yield. A $10,000 investment in the stock five years ago would be worth $25,877 according to S&P data. The ADR started trading on the New York Stock Exchange in May 2002.

Disclosure: No Positions