Emerging market stocks soared before the global financial crisis leading to sky-high valuations and equity prices. Investors’ attraction towards emerging markets has since changed dramatically. This year many of the leading emerging market indices are still in the negative territory are up only slightly compared to developed markets.

The year-to-date returns of some of the emerging market indices are listed below:

- China’s Shanghai Composite: -5.9%

- India’s Bombay Sensex: 20.9%

- Brzail’s Sao Paulo Bovespa: 1.1%

- Chile’s Santiago IPSA: 1.4%

- Mexico’s IPC All-Share: 9.7%

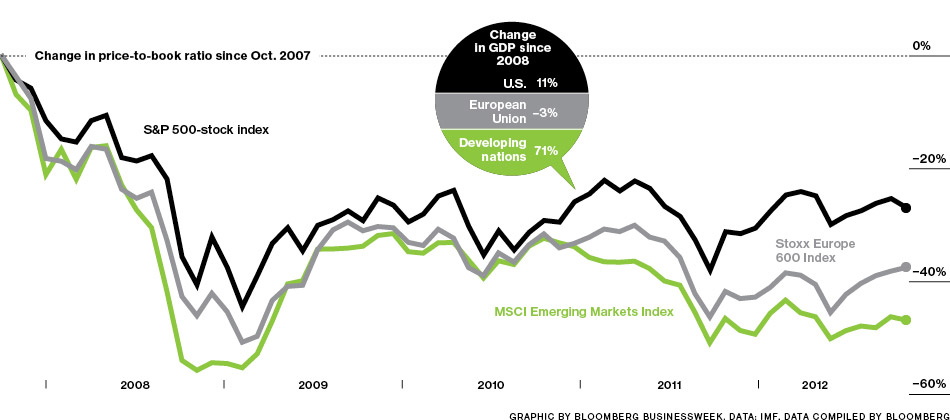

Since the financial crisis, while developed countries have experienced average to poor growth, the economies of emerging countries have continued to grow strong though at a lesser pace than before. This is due to a multitude of reasons some of which include rising household income, higher employment, stable and better banking system, low public debt, implementation of political and economic reforms, infrastructure development, etc. However despite the higher economic growth than developed countries, emerging markets have been re-rated by investors and equities in those markets have fallen more based on the price-to-book ratio than developed countries.

Click to enlarge

Source: Emerging-Market Stocks: The Deepest Dive, Bloomberg BusinessWeek

Many research studies confirm that higher economic growth do not necessarily lead to higher equity prices.So investing in emerging stocks mainly based on economic growth is not a wise strategy. However in the current scenario, some additional factors favor emerging equities over developed equities. For example, many emerging companies are becoming global players and have higher earnings but lower dividend payout ratios. Hence they have the potential to raise payouts in the future. Dividend culture is also being slowly embraced in many of these countries. Another reason emerging stocks are attractive at current levels is that domestic consumption of goods and services is increasing and companies that cater to the domestic market instead of mainly depending on exports stand to benefit from this growth.

Ten emerging market stocks with dividend yields of more than 3% are listed below for further review:

1.Company:Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 3.44%

Sector: Electric Utilities

Country: Chile

2.Company: Banco Latinoamericano de Comercio Exterior SA (BLX)

Current Dividend Yield: 5.61%

Sector: Banking

Country: Panama

3.Company:Telefonica Brasil SA (VIV)

Current Dividend Yield: 5.60%

Sector: Telecom

Country: Brazil

4.Company:Cpfl Energia SA (CPL)

Current Dividend Yield: 6.85%

Sector: Electric Utilities

Country: Brazil

5.Company: Enersis SA (ENI)

Current Dividend Yield: 3.42%

Sector: Electric Utilities

Country: Chile

6.Company:Sasol Ltd (SSL)

Current Dividend Yield: 4.86%

Sector:Chemical Manufacturing

Country: South Africa

7.Company: Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 4.62%

Sector: Telecom

Country: Philippines

8.Company:Malayan Banking Bhd (MLYBY)

Current Dividend Yield: 7.18%

Sector: Banking

Country: Malaysia

9.Company:China Construction Bank Corp (CICHY)

Current Dividend Yield: 5.07%

Sector:Banking

Country: China

10.Company:Banco do Brasil SA (BDORY)

Current Dividend Yield: 7.88%

Sector:Banking

Country: Brazil

Note: Dividend yields noted are as of Nov 9, 2012

Disclosure: Long ENI