Exchange Traded Funds (ETFs) are becoming more popular with investors than mutual funds in recent years. In order to meet the increasing demand ETF providers have sliced and diced the market in as many ways as possible and continue to add new ETFs to their offerings.

From a recent article in The Journal Report of WSJ:

The first ETF in the U.S. now called the SPDR S&P 500 was launched about 20 years ago. Since then the ETF industry has grown by leaps and bounds primarily competing against the mutual fund industry. Some of the interesting tidbits from the journal article include:

- Total number of ETFs = 1,436 (more than 10 times the total 10 years ago)

- Total assets in ETFs = $1.3 Trillion (more than 15 times the total 10 years ago)

The Top Sponsors – The Biggest ETF companies by ETF Assets and Market Share:

- Blackrock- $536.5 billion/40.7%

- State Stree – $328.5 billion/24.9%

- Vanguard Group – $235.7 billion/17.9%

The Big five – The Largest ETFs by Assets:

- SPDR S&P 500 (SPY) = $119.1 billion

- SPDR Gold Shares (GLD) = $74.7 billion

- Vanguard MSCI Emerging Markets (VWO) = $58.1 billion

- iShares MSCI Emerging Markts (EEM) = $38.1 billion

- iShares MSCI EAFE (EFA) = $37.9 billion

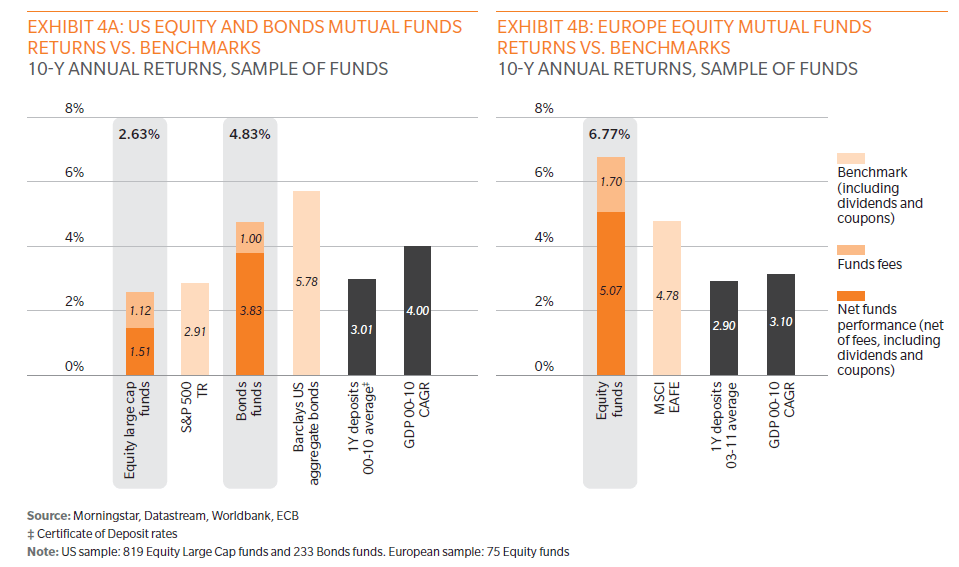

There are many reasons for investors’ preference for ETFs over mutual funds. One of the reasons if the low cost of ETFs compared to mutual funds. Currently ETF providers are engaged in a price war where some of the providers have waived the fees entirely and others are reducing them saving investors money. Another reason for the popularity of ETFs can be attributed to the average performance of equity mutual funds. The following chart shows the performance comparison of US and European equity mutual funds:

Click to enlarge

Source: THE REAL FINANCIAL CRISIS: WHY FINANCIAL INTERMEDIATION IS FAILING, Oliver Wyman

From the Oliver Wyman report:

As has been well documented, most funds perform in-line with benchmarks. After fees, the average mutual fund equity investor will have seen a return of more like 1.5% in the US and 5% in Europe over 10 years (see figure overleaf). Yet these products may have been sold with return illustrations of up to 10%.

Disclosure: No Positions