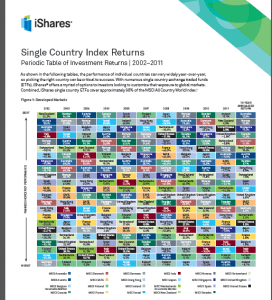

Each year iShares releases the updated Single Country Index Returns chart. The latest version of this chart for Developed Markets from 2002 to 2011 is shown below:

Click to enlarge in pdf format

A few observations:

- Australia, Norway, Singapore and Canada have the highest 10-year annualized returns of over 11.0%.

- The 10-year annualized returns for the U.S. is of over 3.0%.

- Except 2008 and 2011, Canada performed better than the U.S. every year.

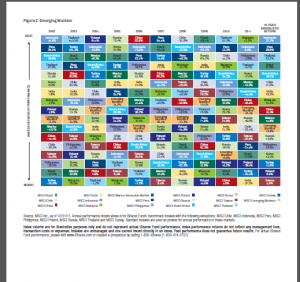

The chart for Emerging Markets from 2002 to 2011 is shown below:

Click to enlarge in pdf format

A few observations:

- The frontier market of Peru was one of the best performing markets for most of the years with double digit returns and had the second highest 10-year annualized returns of about 30.0%.

- While the U.S. had a 10-year annualized returns over 3.0% neighboring Mexico returned about 15.0%.

- The high risk of investing emerging markets was confirmed during the financial crisis of 2008 when each of the BRIC countries fell over 50% with Russia crashing by about 74%.

Source: iShares

Related article:

Single Country Index Returns: Developed and Emerging Markets 2001 – 2010

Single Country Index Returns: Developed and Emerging Markets 2004 – 2013

Some related ETFs:

iShares MSCI Canada Index (EWC)

iShares MSCI Australia Index (EWA)

iShares MSCI Germany Index Fund (EWG)

iShares MSCI Singapore Index Fund (EWS)

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions