Stocks generally outperform bonds in the very long term ranging over many decades. For example, U.S. stocks yielded a compounded total return of 9.9% from January 1926 thru December 2010. However bonds beat stocks over shorter time periods such as 5 years, 10 years and stock returns have been mediocre relative to bonds over other periods, according a research report by Ibbotson Associates. Professor Jeremy Siegel of University of Pennsylvania’s Wharton School wrote the widely popular book “Stocks for the Long Run” arguing the bullish case for stocks over fixed investments over the long-term. He used data all the way from the 1800s to prove his theory. However it is highly unlikely that most equity investors have an investment horizon of very long periods of 50, 100 years or more.

So does it make sense to invest in stocks when bonds outperform them in shorter time periods?

The answer to the above question is an absolute yes. Unlike bonds which are fixed-income instruments, an investor has the potential to earn higher returns by investing in the equities of high-quality, dividend paying well established companies. I came across an article by Seth J. Masters of AllianceBernstein where he proposes a convincing argument in favor of equities.

From the article:

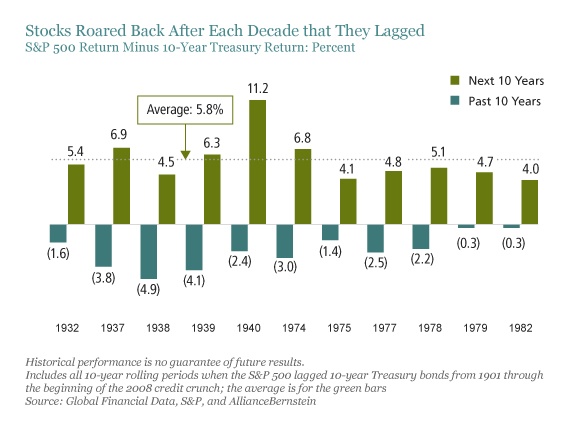

Between 1901 and the onset of the recent credit crisis, there have been 11 10-year rolling periods in which bonds beat stocks, all of them coinciding with the Great Depression or the stagflation of the 1970s. And after each and every one of them, stocks beat bonds for 10 years—on average, by 5.8%, as the Display below shows.

Click to enlarge

Source: What History Suggests About the Future of Stocks, AllianceBernstein

As the chart above shows, while stocks may lag bonds in some periods they can beat them in the following periods. Hence despite the comment about the death of equities by Pimco’s Bill Gross in July investors should not avoid stocks. Business Week’s famous “The Death of Equities” cover story in 1979 turned out be wrong in terms of timing. Similarly Mr.Gross’ prediction might become incorrect as well.

Related ETFs:

SPDR S&P 500 ETF (SPY)

iShares Barclays Treasury Inflation Protected Securities Fund (TIP)

iShares iBoxx $ Investment Grade Corporate Bond Fund (LQD)

iShares Barclays US Aggregate Bond Fund(AGG)

Vanguard Total Bond Market ETF (BND)

Disclosure: No Positions