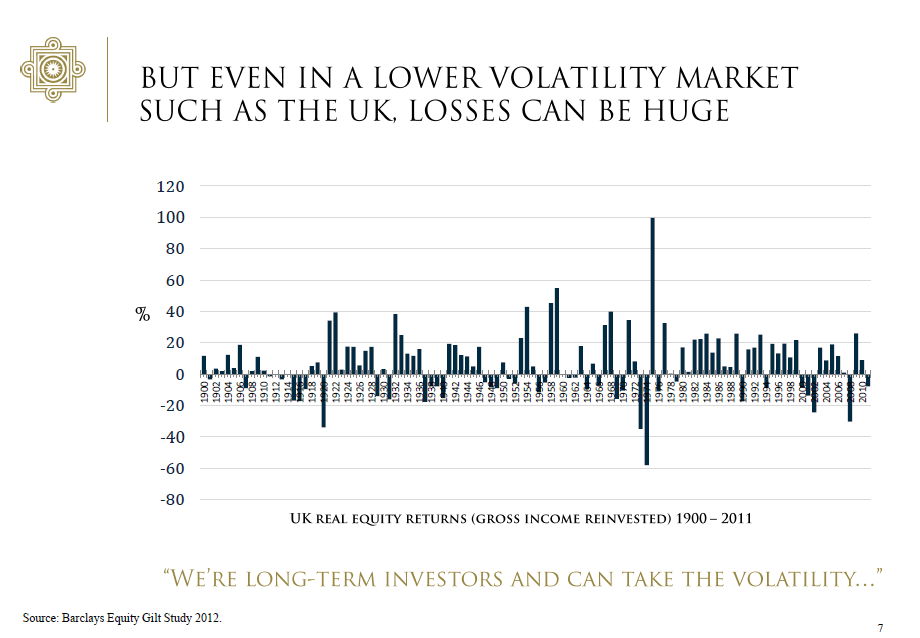

Stocks generally yield higher returns than bonds and cash over the long term. For example, £1 invested in British stocks in 1900 would have grown to £116,394 by 2011. However the £1 would have grown to only £315 if invested in Gilts (British government bonds) or just £202 if held in cash during the same period, according to the Barclays Equity Gilt Study 2012. But holding stocks for the long term takes courage and patience as equity markets tend to be volatile and investors cannot expect a smooth upward trend year after year.

The chart below shows the UK Real Equity Returns from 1900 to 2011:

Click to enlarge

Source: Trustee Training 2012, Asset Allocation, Rathbone Investment Management, UK

While the developed markets such as the UK exhibit so much volatility, emerging markets have much higher volatility.So unlike investing for the long-term in developed stocks it is generally not advisable to hold emerging stocks for the long term.

Related ETFs:

iShares MSCI United Kingdom Index (EWU)

Disclosure: No Positions