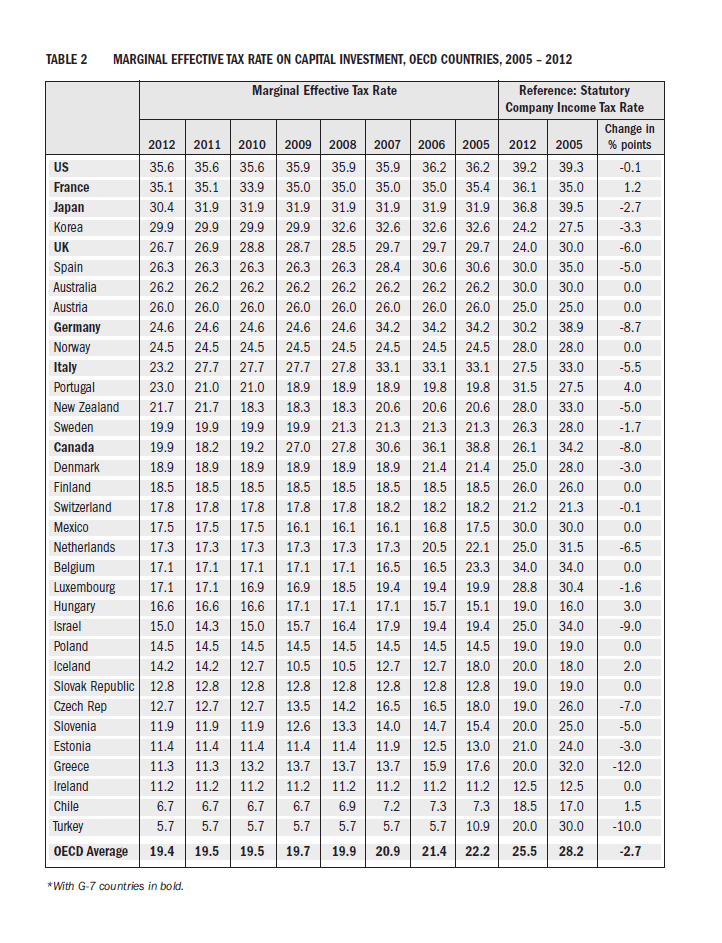

Canada has the most competitive corporate tax rate now among the G-7 countries. The marginal effective tax rate in Canada at 19.9% is now the lowest among the G-7 countries and the 20th most tax-competitive in the 34-member OECD, according to a research report by Duanjie Chen and Jack Mintz of The School of Public Policy, University of Calgary, Canada.

Click to enlarge

Source:

2012 Annual global Tax Competitive Ranking – A Canadian Good News Story

Duanjie Chen and Jack Mintz of The School of Public Policy, University of Calgary, Canada

The authors note that in addition to Canada, Japan and the UK reduced the marginal effective tax rates in 2012 as part of the pro-growth agenda. The U.S. has the highest tax rate at 35.6% which is much higher than the OECD average of 19.4%.