Chile has one of the top growing economies in Latin America. Though the country’s economy is primarily dependent on exports of commodities such as copper the composition of the GDP is slowly changing.

Today though mining is the major industry in Chile, financial services account for about 16% of the GDP according to a Doing Business in Chile report by KPMG. From a size perspective, the country’s total banking assets is equal to the assets of one large Brazilian bank.

Some of the reasons to invest in Chilean banks/financial sector include:

- Chileans are big savers with the current savings rate standing at an astonishing 21.6%.

- The country’s has a mandatory saving system for all dependent employees.

- Due to the lack of company retirement plans and limited government pensions plans, most Chileans have private pension plans which are managed by five asset management firms.

- The financial sector also benefits from the Chilean government running a regular budget surplus for the past few years.

- With the structural changes in the banking sector in 1997 many foreign players have entered the market.

- Under the constitution, both domestic investors and foreigners have the same equal rights.

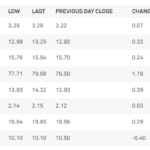

The Top 10 Banks in Chile are listed below:

[TABLE=1061]

Source: Doing Business in Chile, KPMG

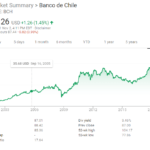

Founded in 1978, Banco Santander(SAN) is the largest bank in Chile. Banco Santander is a unit of the Santander Group of Spain. The second and third largest banks are Banco de Chile (BCH) and Banco BCI respectively.Corpbanca (BCA) is the Chilean oldest bank.Other foreign-owned banks with strong presence in the country include Banco BBVA (unit of Spain’s BBVA), Scotia Bank(unit of Bank of Nova Scotia of Cananda) and Banco Itau (unit of Itau Unibanco of Brazil).

Investment services provider Administradora de Fondos de Pensiones Provida SA (PVD) also offers an option to invest in Chile’s financial services sector.

Disclosure: Long BCH and BCA