Last week I wrote an article discussing the dividend yields of U.S. and foreign stocks. To quote from that post:

Though it is commendable that U.S. companies are increasing their dividend payouts, they still lag when compared to the payouts of foreign companies. Relative to their overseas peers, U.S. firms hold over one Trillion $ in cash and equivalents on their balance sheets. So much higher payouts are possible.

Today Mr.Barry Ritholtz of The Big Picture blog has a post on dividends quoting a Barron’s piece. From the article:

“The benchmark Standard & Poor’s 500 index has a dividend yield of just 2%, one of the lowest of any major global market. European stocks yield an average of nearly 5%, and even the historically low-yielding Japanese stock market pays 2.5%.

American companies have the wherewithal to raise dividends because profits are at record levels and the payout ratio—the percentage of profits paid out in dividends—is near an all-time low at 28%. It has averaged 40% over the past 20 years.” (emphasis added)

Currently the US tax rates for dividends are very attractive for investors. The maximum tax rates for ordinary and qualified dividends are 35% and 15% respectively. However these rates are set to increase in 2013 unless Congress extends the current lower rates for more years. In 2013, the maximum rates for ordinary and qualified dividends will jump to 36% for investors in the 28% tax bracket and 39.6% for those in the higher brackets respectively.

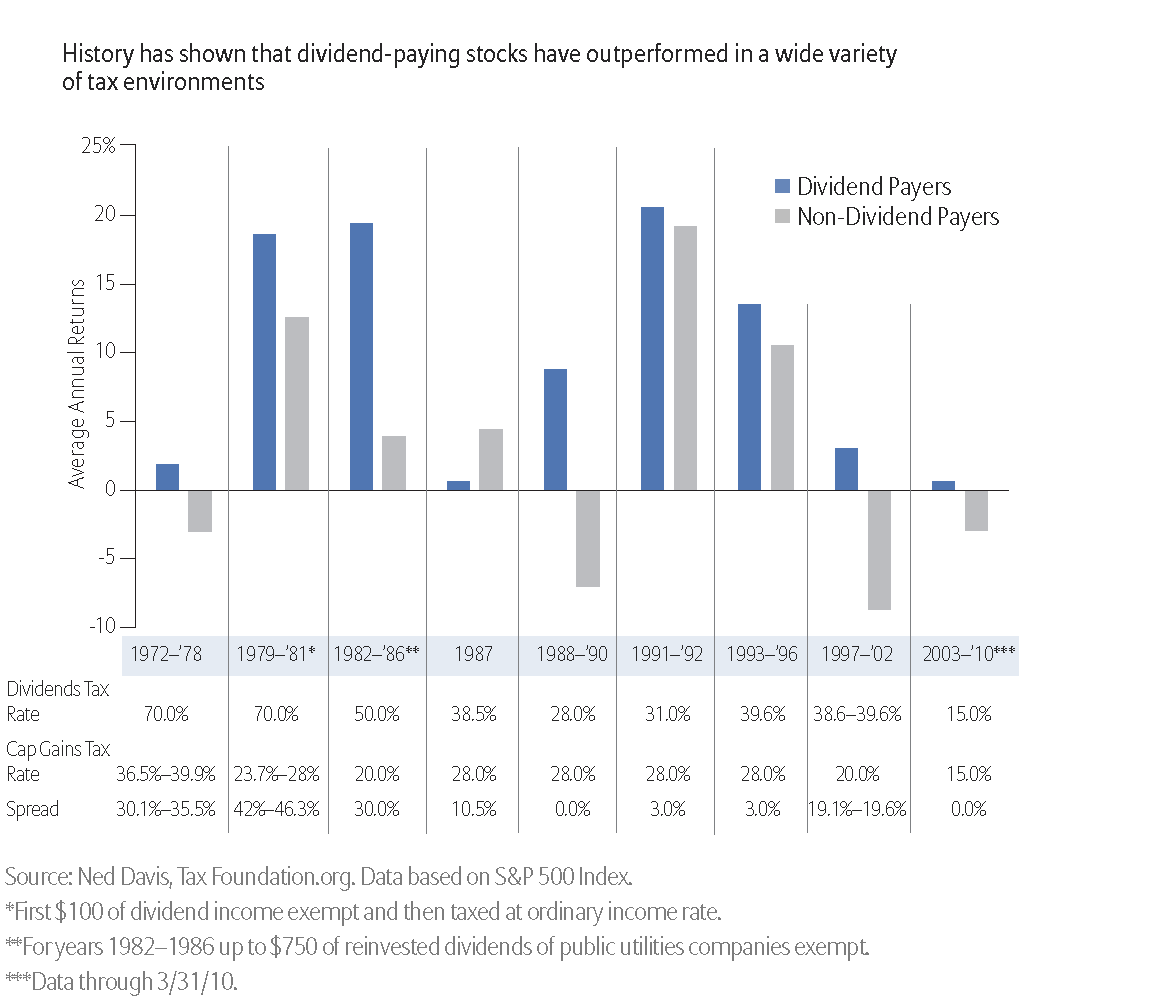

So understandably some investors are worried about the impact of higher tax rates on dividends. They need not be concerned. History shows that dividend paying stocks have performed relatively well at different tax rates.

The chart below shows the performance of dividend and non-dividend payers in various tax environments since 1972:

Click to enlarge

Source: The case for Large cap dividend paying stocks, Sonia H. Mintun, Ancora Advisors, LLC

From 1972 to 1982, despite the dividend tax rate at 70% dividend payers vastly outperformed non-dividend payers. In other periods also dividend stocks performed well as shown above by the dark blue bars.

In summary, regardless of any changes in the dividend tax rates investors are better to stick with dividend paying stocks for reducing portfolio volatility and higher returns.

Related ETFs:

SPDR S&P 500 ETF (SPY)

iShares Dow Jones Select Dividend ETF (DVY)

SPDR Utilities Select Sector SPDR ETF (XLU)

Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions