As the U.S. election campaign picks up momentum one of the favorite topics that will be discussed by politicians from both the parties will be taxes. By default Republicans favor lowering taxes while the Democrats do not. However both parties may be wrong with their beliefs.

In general, where does the U.S. stand in terms of taxes when compared to other developed countries?

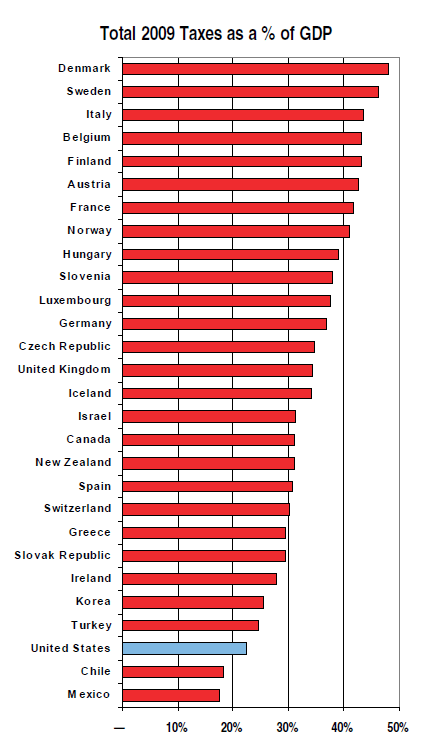

Total Taxes:

Taxes paid by individuals and corporations as a percentage of GDP is one of the meaningful ways to determine whether a country’s tax rates are high or low. Based on this metric, the U.S. has the third lowest taxes among OECD countries in 2009, the latest year for which data is available. The total U.S. state, local and federal taxes in 2009 was 22.6% of GDP. Only Chile and Mexico had lower taxes at 18.2% and 17.5% respectively.

Click to enlarge

Clearly total taxes is lower in the U.S. than most OECD countries. Lower tax collection is one reason the Federal budget is at record high levels.

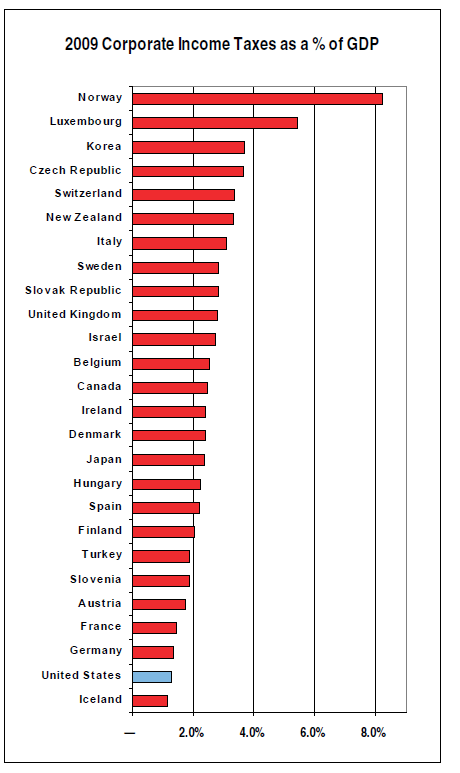

Corporate Income Taxes:

The corporate tax rate in the U.S. is also too low. Based on 2009 data, the U.S. corporate taxes as a share of GDP was 1.9% with only Iceland having a lower rate among the OECD countries. Despite having the lowest corporate tax rate in the developed world, Iceland was one of the first countries to collapse during the global financial crisis. To put the current U.S. corporate tax rate in perspective, in 1965 it was at 4.0% of the GDP.

Personal Income Taxes:

Personal income taxes have also fallen in recent years. In 2000, personal income taxes was 12.3% of the GDP. After former President George Bush cut personal income taxes primarily to benefit the “have-mores”, it plunged dramatically. In 2009 it stood at just 7.7% of the GDP.

Source: U.S. Is One of the Least Taxed Developed Countries, Citizens for Tax Justice

As U.S. tax rates are one of the lowest in the developed world, it appears that even the millionaires are feeling the guilt of paying lower taxes and would like the tax rates to be raised. From a recent Bloomberg article:

Millionaires support Warren Buffett’s view that the wealthiest should pay more in taxes, as long as it’s other rich Americans, according to a survey released today.

About 71 percent of millionaires surveyed said they agree with Buffett, chairman and chief executive officer of Omaha, Nebraska-based Berkshire Hathaway Inc. (BRK/A), that the very wealthy ought to pay more taxes and give more to charity. That included 49 percent who said that they’re “not in the same league” as Buffett and that the higher taxes shouldn’t apply to them personally, according to the survey from PNC Wealth Management, a unit of Pittsburgh-based PNC Financial Services Group Inc. (PNC).

Overall most people would agree that the current corporate and personal tax rates need not be lowered further. Instead of trying to reduce taxes, the U.S. should stimulate economic growth by using other measures. Though U.S. multinational companies are lobbying to reduce the current tax rates so that they can repatriate their cash piles held overseas, it is unlikely that they will invest and create jobs here. In fact, research shows that reducing corporate tax rates has not benefited the economy.

Related:

NY Times: Are Taxes in the U.S. High or Low?