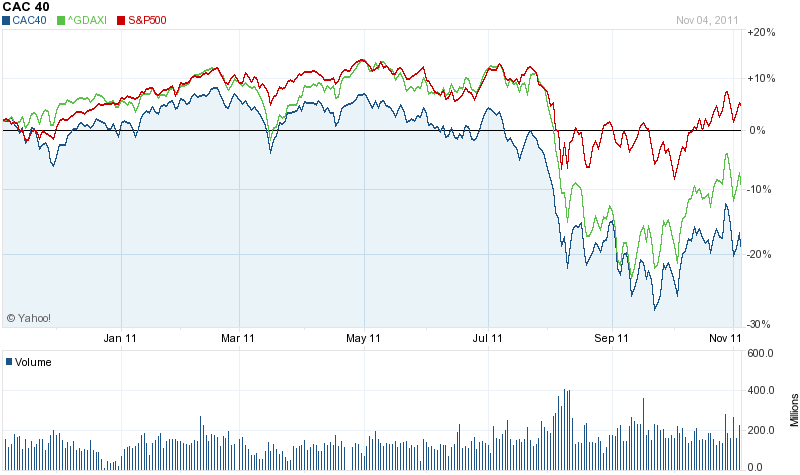

The CAC-40 and DAX indices are down 17.9% and 13.7% as of Nov 4, 2011. Both these indices were off much higher in early October but have since recovered some of the losses as some clarity has began to emerge on the solution to the Euro crisis.

Click to enlarge

Source: Yahoo Finance

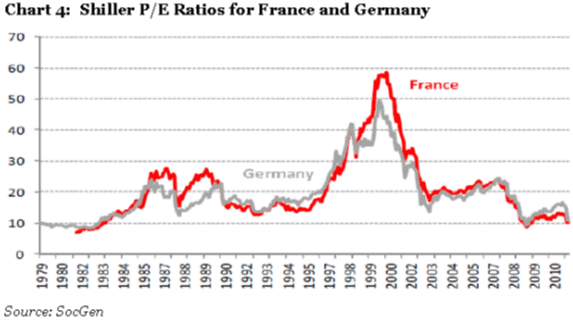

French and German markets are cheap based on the Shiller P/E ratio according to a report published last month by Niels C. Jensen of the UK-based Absolute Return Partners. These two markets are trading at the same level during the credit crisis of 2008 and levels back in 1982.

Note: Also known as the cyclically adjusted P/E, the Shiller P/E smooths the impact from economic cycles by calculating the P/E as a 10 year average and adjusting for inflation.

Via: PSG Angle: Why investing in stocks, makes sense!, PSG Asset Management

According to Neels van Schaik of PSG Asset Management, many of the European stock prices are already reflecting the probability of a recession in Europe or the U.S. Hence at current price levels European companies may offer sound returns to investors willing to hold five years or more.

Ten randomly selected non-financial French and German stocks are listed below with their current prices and dividend yields for further review:

a) French ADRs:

1.Company: AXA SA (AXAHY)

Current Price: $14.47

Current Dividend Yield: $7.10%

Sector: Life Insurance

2.Company: Danone (DANOY)

Current Price: $13.45

Current Dividend Yield: 2.74%

Sector: Food Producers

3.Company: Sanofi (SNY)

Current Price: $34.12

Current Dividend Yield: 5.16%

Sector: Pharmaceuticals

4.Company: Valeo (VLEEY)

Current Price: $23.90

Current Dividend Yield: 3.44%

Sector: Automobile Parts

5.Company: France Telecom (FTE)

Current Price: $17.47

Current Dividend Yield: 11.21%

Sector: Telecom

6.Company: LaFarge (LFRGY)

Current Price: $10.09

Current Dividend Yield: N/A

Sector: Cement

7.Company: Air Liquide (AIQUY)

Current Price: $24.86

Current Dividend Yield: 2.65%

Sector: Chemicals

8.Company: Electricite de France (ECIFY)

Current Price: $5.70

Current Dividend Yield: 5.54%

Sector: Electric Utility

9.Company: TOTAL (TOT)

Current Price: $51.28

Current Dividend Yield: 6.32%

Sector: Integrated Oil & Gas

10.Company:CGG Veritas (CGV)

Current Price: $21.92

Current Dividend Yield: N/A

Sector: Oil Equipment Services and Distributors

b) German ADRs:

1.Company: BASF (BASFY)

Current Price: $70.65

Current Dividend Yield: 4.46%

Sector: Chemicals

2.Company: Continental AG (CTTAY)

Current Price: $74.15

Current Dividend Yield: N/A

Sector: Tire Manufacturing

3.Company:Fresenius Medical Care (FMS)

Current Price: $70.61

Current Dividend Yield: 1.32%

Sector: HealthCare Equipment & Services

4.Company: Henkel AG (HENKY)

Current Price: $49.63

Current Dividend Yield: 2.04%

Sector: Household Goods

5.Company: Siemens (SI)

Current Price: $102.20

Current Dividend Yield: 3.62%

Sector: General Industrials

6.Company: RWE AG (RWEOY)

Current Price: $39.90

Current Dividend Yield: 11.90%

Sector: Multi-Utility

7.Company: Deutsche Telekom (DTEGY)

Current Price: $12.43

Current Dividend Yield: N/A

Sector: Telecom

8.Company: Bayer AG (BAYRY)

Current Price: $65.25

Current Dividend Yield: 3.57%

Sector: Chemicals

9.Company: Adidas (ADDYY)

Current Price: $35.05

Current Dividend Yield: 1.62%

Sector: Personal Goods

10.Company: Hannover Rueckversicherung (HVRRY)

Current Price: $25.01

Current Dividend Yield: 6.57%

Sector: Reinsurance

Note: Prices and Dividend Yields noted are as of market close Nov 4, 2011.

Some observations:

I have included AXA and Hannover Re in the above list though are considered to be part of the financial industry. They are in fact insurance companies and unlike banks they are highly regulated and do not have high exposures to sovereign debt or derivatives. In addition, in countries like France people save a significant portion of retirement savings with insurance companies. Hence from an investment perspective it is wrong to paint insurance firms with the same brush as banks.

Germany-based BASF (BASFY) is the world’s largest chemical manufacturer and holds the leadership position for many years now. Food producer Danone (DANOY) has a strong brand name in developed countries including the U.S. and continues to expand in emerging markets with innovative products.

Disclosure: Long HENKY, RWEOY, LFRGY, VLEEY, AXAHY