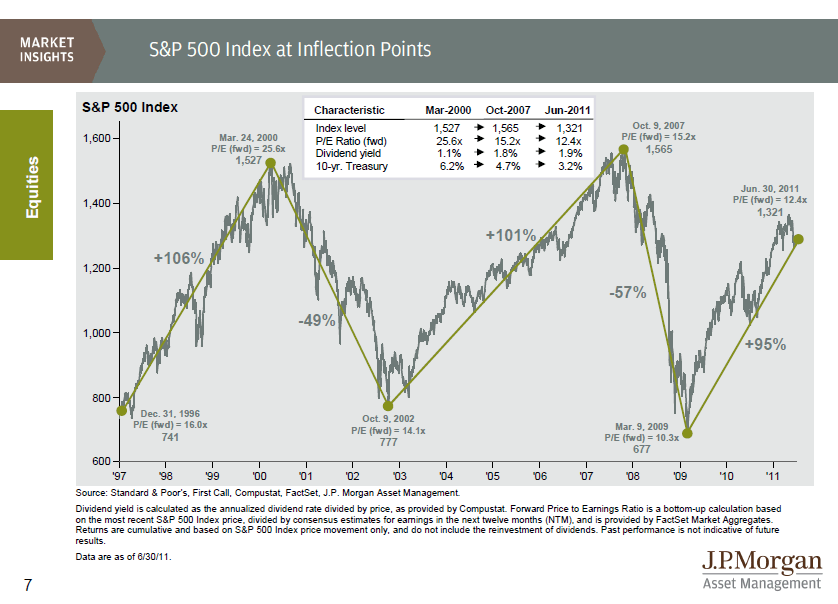

Equity markets fall and rise for a multitude of reasons that no one can predict. So investors should not try to time the market moves. This is especially important for ordinary investors. Sophisticated professional investors such as hedge funds and other traders are able to reap fantastic profits from taking advantage of volatility in the markets but even some of the fail when the strategy backfires.

Click to enlarge

Source: JPMorgan Funds via The Big Picture

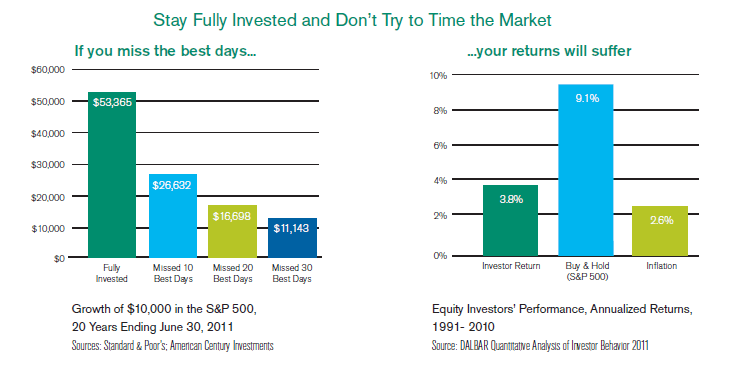

To take advantage of the market gains, one is better off staying fully invested as opposed to repeated buying and selling. As no one can predict the movement of equity markets, even missing out a few days can lower one’s return substantially as shown in the graphic below. However it should also be noted that even staying fully invested does not guarantee a profit.

Source: Time-Tested Investment Strategies for the Long Term, American Century Investments

Related ETF:

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions

What if you miss the 10 WORST days?

If you are lucky enough to miss the 10 WORST days, your returns should be amplified. You may want to run a rough calculation to confirm this logic.