Brazilian stocks have been hit hard in recent months as investors have become increasingly worried about many economic factors including inflation, over-heating of the economy, commodity price volatility, buildup of a credit bubble, etc. Some of the reasons for this fear are well-founded as confirmed by the following data:

- Growth of credit in the last five years has almost doubled from 24% of GDP in 2004 to 46.5% in January, 2011.

- The 90-day delinquency ratio rose to 5.1% of total credit according to Central Bank figures.

- The average debt service to income ratio reached 21.5% at the end of 2010.

But despite all the above reasons, Euromoney magazine notes in an article that there is no risk of a credit bubble in Brazil. Locals also believe that their banking system is in a much better shape than most banks in the developed world.

The following are some of the reasons why credit is not a bubble in Brazil:

- At under half the size of GDP, credit is still a small proportion when compared to developed countries and is also lower than other countries such as Thailand, the Czech Republic and South Africa.

- Brazil is still largely a cash-based economy and it is difficult for most Brazilians to access credit.

- Consumer credit accounts for over 70% of total credit and mortgages account for just 4% of the GDP. Most consumer loans are fixed rates loans protecting consumers from interest rate hikes.

- The average tenor of consumer loans is under two years. Hence banks are protected from future voltatility.

- A large portion of the increase in credit growth has been among higher income A, B and C-rated borrowers who have more experience with credit and therefore present a lower risk of default.

- The Central Bank recently increased the monthly minimum payments required on credit card balances to 15%. This is very high compared to the U.S. where credit card companies can charge as low as just 1.0% of the total balance for minimum payments.

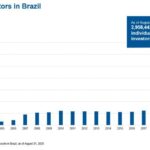

Investors looking to gain exposure to the Brazilian financial sector can buy into the following major banks trading on the US markets as ADRs:

1.Bank:Banco Bradesco SA (BBD)

Current Dividend Yield: 3.48%

2.Bank:Banco do Brasil SA (BDORY)

Current Dividend Yield: 6.50%

3.Bank:Itau Unibanco Holding SA (ITUB)

Current Dividend Yield: 3.61%

4.Bank:Banco Santander Brasil SA (BSBR)

Current Dividend Yield: 7.68%

Note: Dividend yields noted are as of Aug 26, 2011

Another simple and easy to invest in the Brazilian financial sector is via the Global X Brazil Financials ETF(BRAF). The ETF has an asset base of about $7.2 million and an expense ratio of 0.77%. In addition to the above four banks, the fund’s portfolio holdings include many other financials.

Disclosure: Long BBD, ITUB