China is one of the most risky places to invest among the major emerging markets. Though the country follows the capitalist form of economic model in the past few decades, communism remains as only the political system in China. This “Market Socialism” form of government works well in some areas such as providing affordable housing, uplifting of the poor to middle-class, world-class infrastructure for the masses, etc. However in some areas it does not. For example, as the government is heavily involved in all forms of the economy including the running of companies under state-control transparency in accounting and other information needed by investors is not readily available.

In recent years many Chinese firms have listed their shares on the US and other global markets taking advantage of investors’ craze towards all things China. However many of these stocks have not performed well and some are trading well below their IPO prices. Of the 118 exchange-listed ADRs, the majority of them are in the negative territory year-to-date.

This year many Chinese stocks trading on the US markets have been halted or suspended trading including the NYSE-listed Longtop Financial Technologies Ltd(LFT) in May as investors unearthed fraud in their earnings statements. In June, shares of Hong Kong-based Sino-Forest Corp, a forestry company plunged on the Toronto Stock Exchange where it was listed after a research note by the independent research firm Muddy Waters that questioned the company’s assets and basically called the company “a multi-billion dollar ponzi scheme”.

Despite such issues with Chinese companies some investors are still attracted to China due to its economic growth potential. An article in The Wall Street Journal today discussed about pros and cons of investing in China and some ways to invest there.

From Why China Looks Like a Buy :

Buy dividend-paying stocks.One way to reduce the risks of accounting blowups wrecking your portfolio is to buy companies that pay dividends. A 2005 study of U.S. companies by Judson Caskey and Michelle Hanlon of the University of Michigan found that while the fact that a company pays a dividend didn’t eliminate the chance of accounting fraud, it greatly reduces the odds.

If U.S. history is a guide, Chinese dividend-paying stocks could be especially attractive now. Dividend payments were one of the ways that U.S. investors knew they could trust the financials of U.S. companies in the days before the U.S. Securities and Exchange Commission and regulations requiring detailed financial disclosures, says Sam Katzman, chief investment officer at Constellation Wealth Advisors LLC in New York. “If they pay a dividend, it’s an argument that they’re not playing with their accounting,” Mr. Katman says. “That’s where the U.S. was and that’s where the Chinese are now.”

Chinese companies seem eager to win investors’ trust. Of the 147 companies in the MSCI China index, 89% pay a dividend. Despite making up just 12% of the MSCI AC Asia Pacific index market cap, China accounted for 28% of the total dividends paid out, only slightly less than Japan.

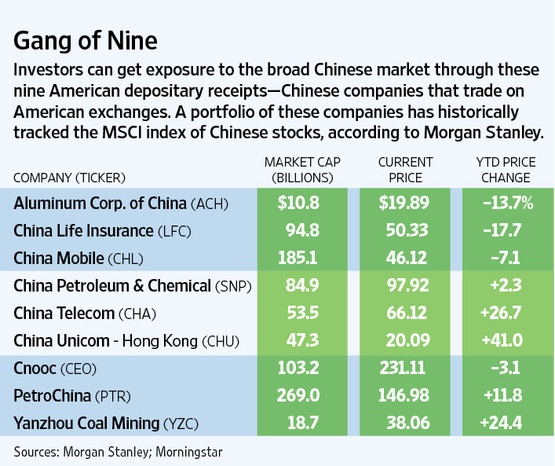

Another option is to try to replicate the index without the financials. A June analysis performed by Adam Parker, chief U.S. equity strategist at Morgan Stanley, found that a portfolio of nine Chinese American depositary receipts—China Mobile, Cnooc, PetroChina Co., China Unicom (Hong Kong) Ltd., China Life Insurance Co., China Petroleum & Chemical Corp., Yanzhou Coal Mining Co., Aluminum Corp. of China and China Telecom Corp.—have reliably tracked the MSCI China index since 2004, with a relatively steady correlation of 0.8 (a correlation of 1.0 means assets trade in lockstep). The portfolio has just 3.7% allocated to financials, compared with 35.8% for the MSCI China index.

CNOOC Ltd (CEO) is one of the largest integrated Chinese oil and gas companies with a market capitalization of about $103 billion. China Petroleum & Chemical Corporation aka Sinopec Corp. (SNP) and PetroChina Co Ltd (PTR) are smaller energy firms with market caps of about $16 billion and $31 billion respectively. Both the ADRs have dividend yields of over 3%. Except China Life Insurance Co Ltd (LFC), all the other eight companies noted above are in the non-financial sectors. Since Chinese banks have large exposures to the real estate industry, the above companies are excellent choices for investors looking to invest in China.

Disclosure: No positions