Italian bank stocks fell heavily on Friday.Trading in some banks was suspended due to high volatility in the Milan Stock Exchange.

From Italian Banks Sidestep Debt Crisis, Not Vice Versa in The Wall Street Journal:

MILAN—With virtually no exposure to Greece and other peripheral euro-zone countries, Italian banks have seemed relatively immune to Europe’s debt crisis.

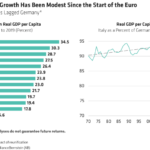

Yet Italian banks face a battle making profits on their core business—lending to companies and individuals across their homeland—as the euro-zone debt crisis pushes borrowing costs up faster than the prospects of Italian economic growth, which is expected to be a listless 1% this year.

Bank shares fell as much as 10% on the Milan stock exchange on Friday, as investors panicked in the wake of a warning by Moody’s Investor Service late on Thursday that it may downgrade the long-term debt and deposit ratings of 16 Italian banks, and changed the outlook on an additional 13 lenders to negative.

The predicament facing banks such as Intesa Sanpaolo, UniCredit SpA and others highlights a new kind of market dynamic, provoked by Europe’s continuing debt crisis, in which sovereign-debt concerns are increasingly dictating terms for the private sector.

“The market is experiencing a great anomaly,” said Antonio Guglielmi, an analyst at Mediobanca in London. “The cost of [bank] funding is now linked to sovereign risk and not to the higher capital of the banks.”

Not only have Italian banks not tapped Italy’s government—which already groans under public debt of 120% of gross domestic product—for funds, but they also have raised more than €10.5 billion, or about $15 billion, in fresh equity capital in a series of capital increases so far this year.

The article notes that one solution for Italian banks could be to raise fees since layoffs is not an option due to union’s demands.

In terms of market performance, the FTSE MIB index is down 5.1% YTD while the S&P 500 is up 0.9%. Germany’s DAX is the only index that is positive YTD among the major European economies.

A Review of Intesa Sanpaolo:

Intesa Sanpoalo is one of the largest Italian banking groups, formed by the merger of Banca Intesa and Sanpaolo IMI. The Group has a leadership position in the Italian market and has a strong presence in Central-Eastern European markets as well.

As of December, 2010 the bank’s core Tier 1 ratio stood at 7.9%, in line with Basel III requirements. In order to raise its core Tier 1 level ratio to 10%, Intesa announced a EUR 5 billion rights issue in April.

Some key facts from a company presentation:

- Leader in all segments with a market share of 16% in customer loans and 17% in

customer deposits. - Strong capital base and best in asset quality class.

- Largest domestic network: nearly 5,700 branches, 17% market share and 11

million clients. - Particular strength in the wealthiest areas of Italy: strong retail presence covering more

than 70% of Italian household wealth. - Selected retail banking presence in Central and Eastern Europe and Middle Eastern and North African countries reaching 8.3 million clients in 13 countries through a network of over 1,700 branches.

- International network with a presence in 29 countries in support of cross-border activities of corporate customers.

Intesa Sanpaolo SpA trades on the OTC market in the U.S. as a sponsored ADR under the ticker ISPNY. The stock currently has 4.78% dividend yield. In March 2009, Intesa ADR fell to as low as $10. After reaching a high of $29 in December of that year, the stock fell again to about $14 in June 2010. Almost a year later it closed at $14.47 on Friday.

More information on Intesa Sanpaolo SpA can be found at the Investor Relations site here.

Disclosure: No positions