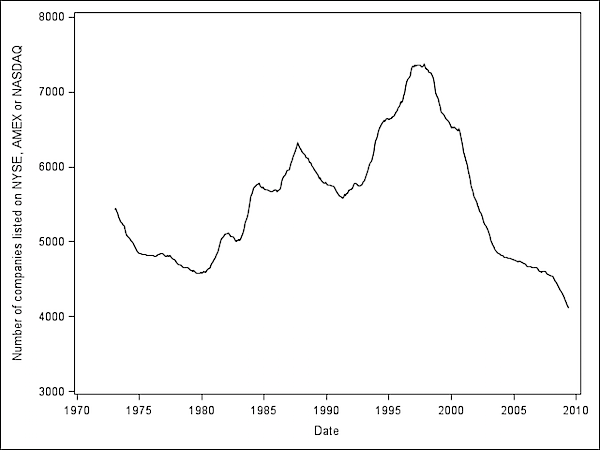

The total number of stocks listed on the U.S. exchanges has declined for many years now following the dot-com bubble. However the total number of mutual funds listed remains very high.

Number of Companies listed on the organized U.S. Exchanges:

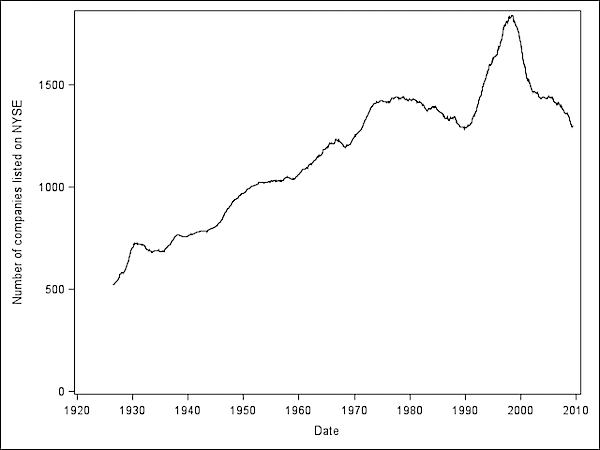

Number of Companies listed on the NYSE:

Source: via Felix Samon @ Reuters

From U.S. Falls Behind in Stock Listings in The Wall Street Journal:

A combination of mergers, fewer U.S. IPOs, lower listing costs abroad and a shift in how investors and stockbrokers do their jobs has driven down the number of U.S. stock listings by a startling 43% since the peak in 1997—all during a period when the number of listings outside the U.S. has more than doubled.

The result is some 3,800 fewer companies trade on the U.S. exchanges today than in 1997, according to consulting firm Capital Markets Advisory Partners. Abroad, there are nearly eight times as many listings as in the U.S., with Hong Kong, China and India among the leading venues. (emphasis added)

Currently there are about 2,760 companies trading on the NASDAQ and 2,312 on the NYSE.

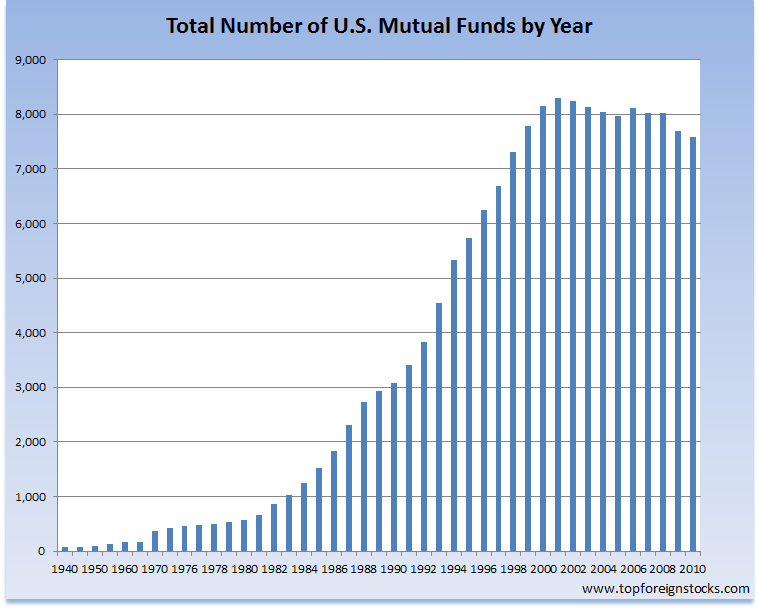

Even as the total number of U.S. listings are declining, the total number of mutual funds trading on the U.S. markets remains very high as shown in the chart below:

Click to enlarge

Source: Investment Company Institute

Most investors are not aware that there are more mutual funds than stocks trading on the U.S. markets. From a total of 564 funds in 1980 the mutual funds industry has had an explosive growth and reached a peak of 8,305 funds in 2001 during the height of the dot com mania. At the end of 2010, there were still 7,581 funds with an asset base of about $11.8 Trillions. Among these 7,581 funds, investors have a bewildering array of share classes to choose from, the total of which reached 21,971.One of the reason for the existence of so many mutual funds is the amount of enormous profits generated by fund companies in the form of management fees and other expenses.

This is a fantastic post–thanks for doing this research–it’s exactly what I was looking for!