The OECD recently published its annual report on income taxes in OECD countries. The report titled “Taxing Wages” shows that the tax burden on employment income rose in 22 of the 34 OECD countries in 2010. However the rise in most cases was small.

Income Tax Rates for one-earner married couples with two children earning the average wage in OECD countries:

Click to enlarge

Source: OECD

The OECD report noted the following:

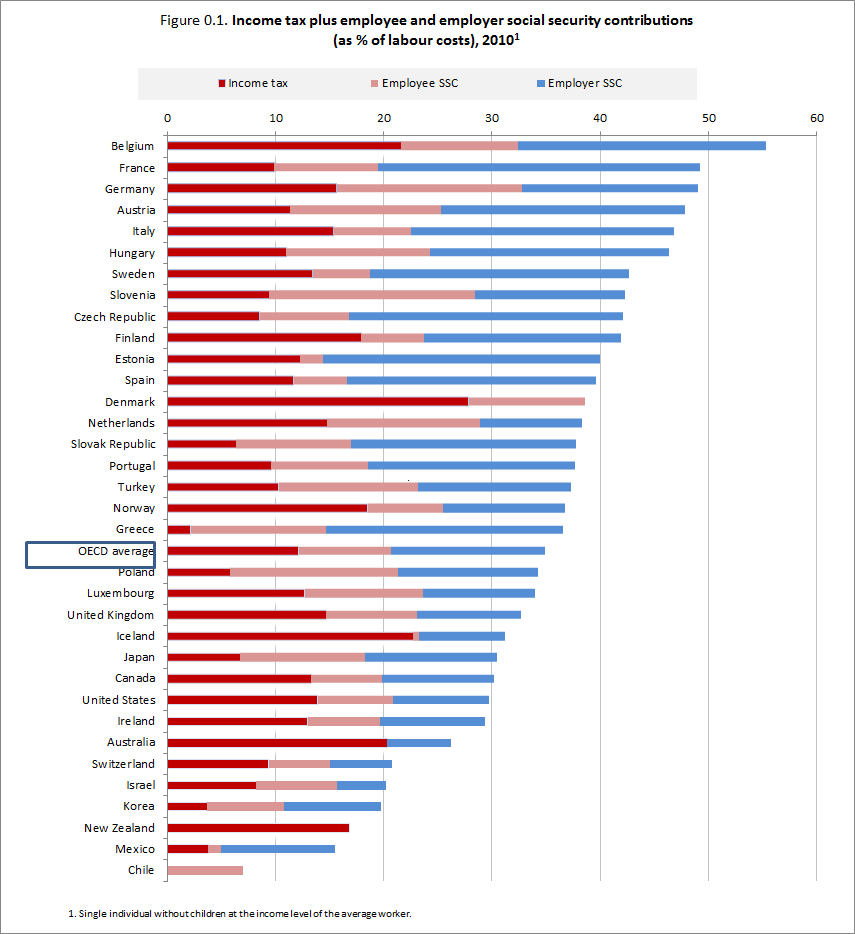

Taxes on wages, including both employer and employee social security charges, are a key factor in companies’ hiring decisions and individuals’ incentives to work. As part of efforts to restore public finances and put the economy on a higher growth path, governments should consider shifting the tax mix away from direct to indirect taxes (e.g. by increasing recurrent taxes on immovable property) and broadening the VAT and personal income tax base by eliminating tax expenditures, rather than increasing personal income tax rates and social security charges.

Definition of “Tax Wedge”:

The “tax wedge†is calculated as the total taxes paid by employees and employers net of cash transfers received divided by the employer’s total payroll costs.

Some key takeaways from the report:

- Belgium, France and Italy were the highest-tax countries for one-earner married couples with two children earning the average wage.

- New Zealand had the smallest tax wedge for one-earner married couples with 2 children earning the average wage (-1.1%) followed by Chile, Switzerland and Luxembourg. The average tax wedge for OECD countries was 24.8%.

- Ireland increased income taxes and the health levy while it reduced child benefits. The impact of these changes on the tax wedge has been partly offset by the decrease in the average wage. Because of the progressivity of tax regimes, lower earnings mean that a smaller share is taken in tax by the government.

- Similar to Ireland, in Greece the strong decrease in the average wage resulted in a decrease in the tax wedge for all families. This is despite of the increase in marginal income tax rates at higher income levels.

- The countries of Australia, Chile, Iceland, Israel, Italy, Mexico, the Netherlands, Norway, Poland, the Slovak Republic and Switzerland put large additional burdens on employment costs through compulsory payments which are not regarded as tax, since they are not paid to government, but to privately-managed pension funds or insurance companies. Often, these are paid by the employer, but in Chile, Iceland, Israel, the Netherlands, Poland and Switzerland a large proportion of this payment is paid by employees.

- The U.S. income tax rate is lower than the OECD average as shown in the chart above.

I enjoyed your comment very much. Would you be able to provide me with the specific numbers behind the chart in a centralized table? Also, I would like to quote your material, with appropriate attribution. Would that be OK?

Best regards,

Vincent J. Truglia

Principal and Managing Director of Global Economic Research

Granite Springs Asset Management LLC

950 Third Avenue

New York, NY 10022

http://granite-springs.com

Hi Vincent

Thanks for your comment.Sure.I just sent you the data behind this chart in a table to your email. Let me know if you do not receiev it.

Sure.Please feel free to quote my article with attribution.

Thanks

-David

In view of the fact that U.S. taxes are lower than the OECD average, why does the Republican Party continue to insist that the U.S. has a spending problem rather than a revenue problem? Could it be because of their desire to shield the wealthy from tax hikes? Considering the present taxation level and widening income inequality since 2000, a tax increase on the wealthy is not only fair–but necessary–for social and budgetary reasons.

Scott

I would agree with you on the issue of taxing the wealthy. Republicans continue to believe in false ideologies.The wealthy in the U.S. are multiplying their at wealth despite the crises in recent years and the middle class is getting crushed.