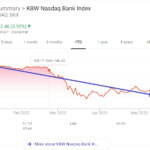

After the recent financial crisis many banks have shored up their balance sheets and are now raising dividends due to increasing earnings. However some investors are still avoiding bank stocks according to a piece in the Journal yesterday. From the article:

Nearly 300 banks had reduced or discontinued their dividends since 2008, saving the industry nearly $100 billion in shareholder payouts, according to boutique investment bank Keefe, Bruyette & Woods Inc.

Now, more than a dozen banks have raised dividends so far in the second quarter, on top of the 39 financial institutions that raised payouts earlier this year, according to KBW research.

After passing regulatory tests to probe banks’ readiness to withstand financial shocks, 10 of the nation’s largest banks are poised to return more than $10 billion to shareholders this year, according to RBC Capital Markets.

Still, some investors who were badly burned by the financial crisis are steering clear of bank stocks.

Despite the improved earnings that many banks reported last month, shareholders worry the fragile economy could crimp nascent demand for new loans. Rising regulatory costs and more-stringent capital requirements may slow revenue and profit growth for the next few years, they fear. At the same time, regional and smaller banks continue to grapple with piles of bad precrisis loans.

“My clients, especially the retired ones, are still scared,” said Frank Shull, vice president at Lara, Shull & May LLC, a money-management firm in Falls Church, Va., that invests on behalf of wealthy individuals.

“Obviously, the resumption of dividends is good, but we would rather not be early” investors in the stocks, he said. “There are still a lot of banks that we are unsure of.”

Rising earnings suggest more dividend increases on the horizon.

The rate of the industry’s earnings recovery is outpacing the amount of capital being returned to shareholders. The banking industry’s dividend ratio—as measured by dividing the payouts by earnings—stood at 25.7% in the first quarter, the lowest first-quarter level since 1993, according to Sandler O’Neill + Partners.

As mentioned in the article above for some investors avoiding bank stocks may be the best option. But those that are willing to make a long-term investment and stomach some risk can nibble at a few of these bank stocks. With hundreds of banks trading on the markets it is a challenge to filter and identify candidates for potential investment.

I have listed ten mid-size bank stocks below with their current dividend yields. These were the top ranked banks from last year’s Top 150 Performers list published by the Bank Director magazine.

1.First Financial Bankshares Inc (NASDAQ:FFIN)

Current Dividend Yield: 1.73%

2.Bank Of The Ozarks Inc (NASDAQ:OZRK)

Current Dividend Yield: 1.62%

3.Glacier Bancorp Inc (NASDAQ:GBCI)

Current Dividend Yield: 3.46%

4.Westamerica BanCorp (NASDAQ:WABC)

Current Dividend Yield: 2.84%

5.Republic Bancorp Inc (NASDAQ:RBCAA)

Current Dividend Yield: 2.63%

6.Bank Of Hawaii Corp (NYSE:BOH)

Current Dividend Yield: 3.69%

7.International Bancshares Corp (NASDAQ:IBOC)

Current Dividend Yield: 2.16%

8.1St Source Corp (NASDAQ:SRCE)

Current Dividend Yield:3.02%

9.CVB Financial Corp (NASDAQ:CVBF)

Current Dividend Yield: 3.49%

10.Northern Trust Corp (NASDAQ:NTRS)

Current Dividend Yield: 2.24%

Disclosure: Long GBCI