****** UPDATE ****:

For the 2021 tax rates go to: Dividend Withholding Tax Rates By Country 2021

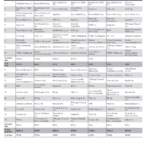

One of the factors that investors need to consider when investing in foreign stocks is taxes since it reduces the effective rate of return on an investment. Governments of most countries try to recoup millions in taxes from dividends that are paid to foreign investors by companies located in their countries. For example, when a U.S.-based investor invests in France Telecom (FTE) ADRs, the French government will deduct 25% in taxes on all dividends paid. Hence though TEF currently has a 6.98% dividend yield, the actual yield that this investor receives will be less. However the IRS allows a foreign tax credit (filed with IRS Form #1116) to be taken using which this investor can deduct the taxes paid to the French government. This is done to avoid double taxation of dividends. There is a maximum limit to this tax credit.

A few countries do not charge any taxes on dividends paid to foreign investors. So foreign investors receive the entire dividends paid by companies based in those countries. For example, the U.K. charges no taxes on dividends paid by British companies (excluding REITS) to U.S. investors. So an investor in National Gird Plc (NGG) will receive the complete dividends paid at the current dividend yield of 4.68%.

*Companies incorporated in mainland China and listed in Shanghai and Shenzhen. These companies are quoted in Renminbi and are only available to Mainland and Qualified Foreign Institution Investors (QFII).

** Companies incorporated in mainland China and listed in Shanghai and Shenzhen. B-shares in Shanghai are traded in U.S. dollars, while B-shares in Shenzhen are traded in Hong Kong dollars. B-shares are available to mainland and foreign investors.

***Companies incorporated in mainland China and listed on the Hong Kong Stock Exchange.

^Companies incorporated in Hong Kong and listed on the Hong Kong Stock Exchange.

Source: Dow Jones Indexes, Other

Note: Please note that the above information is known to be accurate from the sources used. These rates do not apply to non-U.S. residents. Consult with a tax adviser before making any investment decisions.

Some points to remember before investing in foreign stocks:

1. Germany charges 26.4% tax on dividends only on stocks held in taxable accounts.

Update (2/23/17): Germany charges dividend withholding taxes on stocks held in any qualified retirement account such as a Roth, Traditional IRA, etc.

2. The following countries have tax-treaties with the U.S. which allows favorable treatment of dividends earned by US investors investing in those countries:

Australia, Austria, Bangladesh, Barbados, Belgium, Canada, China, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Kazakhstan, Korea, Latvia, Lithuania, Luxembourg, Mexico, Morocco, Netherlands, New Zealand, Norway, Pakistan, Philippines, Poland, Portugal, Romania, Russian Federation, Slovak Republic, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Thailand, Trinidad and Tobago, Tunisia, Turkey, Ukraine, United Kingdom, and Venezuela.

Source: The IRS

Without the tax treaties U.S investors will pay higher taxes. The Netherlands has a statutory tax rate of 25%. But due to the special tax treaty with the U.S., American investors in Dutch companies are charged only 15% as shown in the table above.

3. It is generally not advisable to hold foreign dividend-paying ADRs in IRAs and other non-taxable accounts since one cannot recover the taxes paid to a foreign country.

4. Canada charges a 15% tax on dividends held in non-taxable accounts. But due to a policy change in 2009, dividends and interest income are exempt from this 15% tax if the investments are held in IRA or 401(K) accounts. So U.S. investors can hold Canadian banks such as bank of Novo Scotia (BNS), Royal Bank of Canada(RY) or other dividend-paying stocks like Enbridge (ENB)Â in their IRAs for the long-term without worrying about taxes on dividends.

5. Though the above table shows that Chile has a 35% withholding tax rate, in my personal accounts the depository has deducted only about 22% in taxes on my Chilean dividends. This could be due to any recent change in Chilean tax laws.

For more information about U.S. tax treaties with other countries refer to the Publication 901 on the IRS web site.

Click to download:

- Withholding Tax Rates by Country (as of Feb, 2013) document in pdf (Source: Dow Jones Indexes).

- Withholding Tax Rates by Country (as of March, 2012) document in pdf (Source: Dow Jones Indexes).

- Withholding Tax Rates by Country (as of Sept, 2010) document in pdf (Source: Dow Jones Indexes).

Also checkout:

- Withholding Taxes on Dividends, Interest and Royalties by Country (Source: Deloitte International Tax Source)

- Compare Tax Treaty Rates Between Countries for Dividends, Interest and Royalties (Source: Deloitte International Tax Source)

- Claiming Foreign Taxes: Credit or Deduction?, April 2013 (Charles Schwab)

- Dividend Withholding Tax Rates By Country 2014 *** NEW

Disclosure: Long BNS, RY

Hi David, nice post and a lot of information. But do you have any info on taxes applied by US to foreign investors? I am a resident of Spain (not a Spanish citizen) and I’d like to invest in US stock market. And of course, I’d like to know how my income (dividends and income from selling the shares) is going to be taxed. Do you have any clue about this?

Thanks

Jo

Sorry for the delayed reply.Unfortunately I do not have the information you are looking for.However if you invest in US stocks, the US government may deduct some tax at source when you receive dividends or capital gains and you may be able to get a credit from the government of Spain when you file taxes. This way you do not end up paying taxes twice.

Thanks.

David,

Thank you for this information. I have been thinking about investing in stocks outside the US; but, needed this info before proceeding. You answered all my questions and more. I have saved this site in my Favorites.

Susan

Thanks Susan for your comment.Glad you like this information useful. Please checkout my site often as I write mostly about foreign investments.

Can you publish or send me a list of foreign companies in the countries that don’t withhold taxes who pay dividends? (Like NGG which you mentioned in your article.)

Thanks

Thanks Brett for the comment.Unfortunately currently I do not have a list of such companies.But definitely this will be an idea for a future article.Please keep checking my site often.

Thank you for your informative website. Please clarify the following: We are US residents and receive UK dividends, what is the withholding requirement? It seems according to your withholding Tax Rates sch the tax rate is 0, due to tax treaty, however, in other places that I have researched, it seems that the withholding rate is 15%?

Also, is there a form that we must file to prevent them from withholding? or if we have to withhold, is there a form that we must file to claim our money back?

Thank you very much for your help.

I’f confused. I’m looking at a Brazilian stock for my IRA. When I click on Withholding Tax Rates by Country document in pdf, it shows a zero tax rate for Brazil. But the table above in the main article shows a 15% withholding rate. Which one is correct?

Paul

The rate (15%) shown in the table for Brazil is correct. I am not sure why the pdf that I downloaded from Dow Jones is showing 0% incorrectly.

I just checked my own Brazilian stock dividends and my broker has deducted 15% withholding taxes.So 15% is the correct rate for Brazil. Thanks.

Rach

For UK my data shown above (0%) is correct. The British government does not charge taxes to US residents due to tax treaty. However that 0% is for common stocks of regular firms only. For REITs and other companies they will charge withholding taxes.

There is no form you need to file to prevent withholding taxes by UK. Your broker should automatically take care of that. If your broker deducts taxes contact them and question why. You can claim your foreign taxes paid on the IRS form as a “Foreign tax Credit” when you file taxes. I think this is a separate schedule or a line item when you do capital gains and taxes.Thanks.

Could you please tell me where you found

4. Canada charges a 15% tax on dividends held in non-taxable accounts. But due to a policy change in 2009, dividends and interest income are exempt from this 15% tax if the investments are held in IRA or 401(K) accounts. So U.S. investors can hold Canadian banks such as bank of Novo Scotia (BNS), Royal Bank of Canada(RY) or other dividend-paying stocks like Enbridge (ENB) in their IRAs for the long-term without worrying about taxes on dividends.

I read Publication 597 IRS, and failed to get this info from there.

Thanks.

Byron

I found that information online at the time I wrote this post.I did not make a note of the source of that information. Let me look into this tonite and post a source here. Sorry about that.

Thanks for your understanding.

-David

Sorry to regress to an earlier point (on Brazilian holdings) but I am speaking to an investment firm in Brazil whose clients are largely from abroad and according to them, as well as according to Deloitte and other sources I have seen via internet, Brazil does not withhold any tax for foreigners enjoying dividend income issued by a Brazilian firm. However, I see that in the case of US citizens, evidently 15% is applied. Could this be a special case only for US based foreigners? I know the tax treaty issue between the US and Brazil is still pending resolution but if the Brazilian government withholds, what becomes of that money? Does it stay in Brazil and due to lack of a tax treaty force the US citizen to pay dividend tax again in the US?

Thanks for any insight on the matter.

Thomas

Sorry for the delayed reply.

I am not sure.Brazil deducts 15% withholding taxes for US-based investors.Not sure how they treat other foreigners. If the treaty is passed, then it depends on when they make it effective. I am sure they may not refund any money already withheld by Brazil. I would think that the US citizens will have to pay taxes due the lack of the treaty.

Paul,

Great Site but I continue to be confused re the amount of the withholding. I am US citizen living in US

Recently rcvd dividends on the following ADR`s in taxable acct. Can you assist with clarification-Thank RV

TOT(Fr) 15% withheld vs 25%

TLYSS (Aus) 0 vs not listed

TNE(Br) 0 vs 15

E (Italy) 25 as listed

NZT (NZ) 15 vs 30

SCCO (Peru) 0 vs 4.1

SDRL ( I think Bahamas) 0

vs not listed

Paul- sorry Aus was listed at 30%. Missed it due blue highlighting

Richard

For France, I got taxed at 25% for one of my French holdings.

Not sure why they dedudcted only 15% for TOT.You may have to

contact your broker.

Not sure about TLYSS dividend tax.

For my Brazil holdings also I am getting taxed on dividends

by Brazil compared to your 0%.Again you may have to check it

out with your broker since you it is in a taxable account.

For all other countries, I am not sure about the discrepancy.

I would assume that my table above is correct but things can change

any time. So you may have to dig around a little online to

solve this puzzle.

Sorry couldn’t be of more help.

Thanks

-David

David,

Great post. Wish I had found it prior to my purchase of (F)La Farge common stock. I have this stock in my IRA account. Per the French/US Treaty, what will France tax be for dividends and capital gains?

Frank

Sorry for the delayed reply.

France does charge taxes for stocks held in IRA accounts. With one French stock held in my portfolio, my broker deducted 25% as Foreign Tax Withheld. So it is 25% for dividends. France won’t charge you for capital gains but you have to pay US taxes as applicable.

For more details on the tax treaty between France and US, please check out the IRS site at : http://www.irs.gov/publications/p901/ar01.html#en_US_publink1000219359

Thanks.

David,

thanks for your response. I’m now considering moving my investment from La Farge (F) to Deuschte Bank (G). This move because you post above, that US/German Tax Treaty recognizes “no tax” on dividends paid to an IRA Account.

Am I right in assuming that there will be “no tax” on capital gains?

Thanks,

What a find your site is!

I’m currently chasing down my broker who insist on applying full 30% WHT (based in Switzerland) on my dividend from US Stock.

I’m a little perplexed by this as I read that by submitting to them (as a withholding agent) IRS form W-8BEN they can exempt me and I pay Swissy net taxes. Don’t want to have to wait 18 months for it though.

30% is a huge chunk out of quarterly income esp. as I want to reinvest it to build up a holding in the stock.

What did make me smile was your chart showing nil rate WHT to US investors of British dividend income stocks. So as a native Brit my own gov treats me less fairly (with the 10% WHT) than a “foreigner”!… Life just ain’t fair.

When my 1100 shares of Shamir optical was paid to me(after Merger and acquisition by Essilor) l 24% was forwarded to the Israeli govt, I was informed that My declaration of status for Israeli income tax purposes was not processed(possibly lost or misplaced) therefore Ameritrade forwarded the 24% to Israel.

Ameritrade tells me its not in their hands and I have to deal with The Israeli tax dept. by myself.

Can you please advise how I can retrieve that 24%.

Thanks

Joseph

I would check again with Ameritrade on why they lost/misplaced your status declaration.It is their responsibility to confirm that with the Israeli govt. If they will not help, then please go to the Israeli Tax Dept site and seek their help. I am afraid that may be the only way to solve this issue.

Thanks

-David

Joseph

I would check again with Ameritrade on why they lost/misplaced your status declaration.It is their responsibility to confirm that with the Israeli govt. If they will not help, then please go to the Israeli Tax Dept site and seek their help. I am afraid that may be the only way to solve this issue.

Thanks for your comment.

-David

David,

Does the withholding tax also apply to capital gains? For growth stocks in emerging markets, I am less concerned about taxes on dividends. If not, is there any reason why an EM growth stock wouldn’t be a good candidate for my Roth IRA?

Thanks,

Dan

Dan

Nope.The witholding tax does not apply to capital gains.

Yes.We not worry about dividends for EM stocks. Those stocks are good to be held inside a Roth IRA. However as EM stocks are volatile holding them in a Roth IRA for retirement is a bit risky unless one can devote time to monitor them and book profits/losses when needed. But allocating a portion of portfolio is fine.I can’t think of any other reason not to own them in a Roth account.

Thanks

-David

First thank you for this education on Adr stocks.Through my IRA Account I am holding Siemens,ticker SI from Germany

For the last two years I received their dividend minus the

26.4%tax withholding which I like to recover.Would you be

able to show me the way

Thank you

Hubert

I am in the USA and have an international investor who wants to fund my project here in the USA. The investor has actaully tried havign his broker trasnfer the funds into my bank account here in the USA but the broker has informed me the European Tax authority is telling the broker the trasnfer cannot go thru until I pay a 3% tax fee on the funds?? I do not understand this-why do I have to pay a 3% tax fee for the funds I am receiving from the European government isnt it the investor’s responsibility to pay this tax for it is for his investment into my company in the USA not for my investment into his company in Europe. Please help me and any help you may be able to provide please know will be greatly appreciated!!! Thank you!!

Rob

Sorry for the delayed reply.Unfortunately I am not able to help much with your issue. I would think that tax payments are the responsibility of the investor. So I would ask your investor to contact the tax authority in Europe and check with them. You should not have to pay that tax.

-David

Hubert

Thanks for the note.Sorry for the delayed reply.

Unfortunately if Germany deducted 26.4% withholding tax in your IRA account holdings there is no way to recover it. This is one advantage of holding foreign stocks inside an IRA account. In order to take full advantage of dividends from foreign stocks you have to hold them in non-retirement accounts. Hope this helps.

-David

Hi David! I’m a permanent resident of Canada wishing to buy stocks in my home country (Philippines). I will be utilizing the cost-averaging method thus, will be buying stocks online on a regular basis. Do I need to pay taxes on dividends earned from these stocks here in Canada?

Thank you.

Can some one provide the new tax slab for WTH tax for foreign investor,or any link ?

South Africa introduced a withholding tax on dividends at a rate of 15% with effect from 1 April 2012. While South Africa has a double tax agreement with the USA the DTA only reduces the withholding provided the shareholder has more than 10% of the voting stock in the South African corporation.

Maybe someone can help me with this question. For countries that withhold a foreign tax on dividends the advice seems to be to not hold those stocks in a tax advantaged account such as an IRA. The thinking is that you can hold it in a taxable account and reclaim the tax paid when you file your taxes but you would still end up paying U.S. taxes on the dividend income. So the benefit of NOT owning the stock in a tax advantaged account is only equal to the difference between the foreign and U.S. dividend tax rate. Am I thinking about this correctly? I just did some quick looking into what the current U.S. dividend tax rate is and could not even find anything definitive. I think avoiding the complication is possibly worth holding the stock in my Roth. Thanks.

Dividend are paid from net income after taxes of course and then the withholding tax on US Dividend paying stocks held by non resident of the US is 30%. Thats certainly not an incentive to attract capital.

Does Canada withold 15% on dividends for U.S. Non profit organizations.

Thanks,

guru

David…..very good information. The withholding tax rate chart is very helpful. Contacted my broker questioning 30% withholding on “Sanofi-Aventis” instead of 25% on my May dividend. Couldn’t locate any info regarding change in France’s tax withholding.

Thanks, for any information.

Chris

This site is really great. Although it is mostly for US resident, I suspect most countries treat all foreigners the same (before treaties). It would be great if there is also a summary on tax rates on bonds income as well as capital gains.

Thanks for your comment. Yes I agree with you.

Yes it would be great if I have the withholding taxes on bonds and capital gains as well. I have started collecting some data on this topic. I will be posting an article in one or two weeks.

You have to be careful using discount brokers. Many of them do not observe the tax treaties, and the customer is left having to go back to the country of origin to get a refund. I’m stuck with trying to recover a large Dividend from Siemens. My stock was held in an IRA and, according to your article, no taxes should have been charged, but I got hit with the full 26%+. It’s a difficult and chancy procedure to get it back from Germany. I will try, however.

Ken

Thanks for your comment.

I did not know that some brokers such as yours give their customers a hard time.They have to abide the tax treaties. In your case there is no other option other than dispute the issue with them. Trying to get it back by an individual investor can be tricky and a nightmare. Good luck!.

-David

Hi, I had 1000 share of SAYCY . When this stock withdrew from US stock market,India govt with held 40% tax on it . Is there is any way I can get that tax back >Please Let me Know . Thank you

There is no way to get it back since the withdrawl has already happened. But I would contact your broker and see what they say. They can advise you how to contact the appropriate agency in India. It will a long fight. Good Luck.

Hi David,

I want to have VN-Index of stocks in Vietnam market from 2006-2012. How can I get it. Could you help me! Thank you so much, David!

Best wishes for you and your family!

Lanh,IMBA

Hi Lanh

Thanks for your comment.

Unfortunately I do not have that information on my site yet. However you can do some research online and

you should be able to find it. Here are some links that might help:

http://www.vaneck.com/funds/VNM.aspx

http://www.bloomberg.com/quote/VNINDEX:IND

http://en.stockbiz.vn/IndexChart.aspx?Symbol=HOSTC

http://talkvietnam.com/2012/10/vn30-provides-a-better-reflection/#.UTtat9aKLEw

http://www.hsx.vn/hsx_en/Modules/Statistic/VN_Index_Stock.aspx

http://en.wikipedia.org/wiki/Ho_Chi_Minh_City_Stock_Exchange

Thanks

-David

Hi,

I am holding 200 shares of Safran , a french company and I am Indian and staying India. Since 5 years I am noticing that 25% tax (TDS) is deducted on dividends. Is there way to reduce this ? If yes, what is procedure or formalities that I need to complete it.

Thanks,

Sanjay

Sanjay

Thanks for your comment.

Unfortunately there is no way to reduce the taxes withheld on dividends.This is a way for France to tax investors who gain from investing in French companies.

Hi David,

Do you know how to calculate Return of market, Return of stock, where do we get the price of market, the price of stock, are they different? and beta, is the beta change every day or how? could you give me an example. Thank so much, David,

have a nice day!

Lanh, IMBA

best article i’ve ever read on this subject. thank you

Am I reading this right? Germany does not take out tax if you hold the stock in your IRA? Thanks for the clarification, I don’t know if the rules have changed since then since this article is a few years old.,