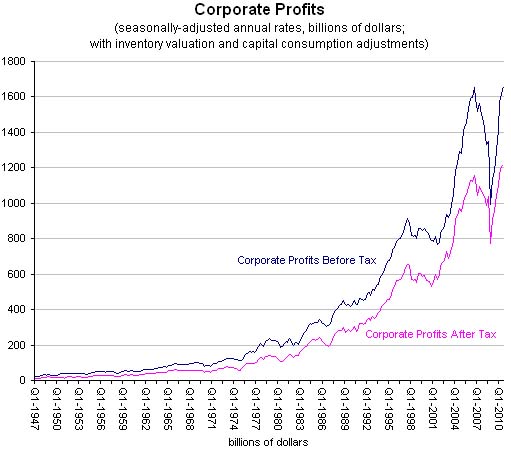

U.S. companies earned profits at an annual rate of $1.659 trillion in the third quarter, according to a Commerce Department report released Tuesday. In non-inflation adjusted terms, this is the highest figure since the government started keeping track over 60 years ago. Since the credit crisis ended, many businesses have resumed growing profits but not with creating more jobs.

The unemployment rate remained unchanged at 9.6% in October with 14.8 million persons unemployed according to official figures.

U.S. firms slashed 8.5 million jobs during the last recession. Millions of these workers still remain unemployed. However corporate profits are soaring to pre-crisis levels. This is because American businesses are able to increase profits by rising productivity, increasing exports, cutting costs and in some cases raising prices. Productivity simply means extracting more or the same amount of work using fewer number of numbers.Globally U.S. companies are leaders in productivity due to the corporate culture prevalent in the U.S. and the fierce competition in many industries. Hence in the current situation they are wringing out more profits with fewer workers. This concept was illustrated in a recent Bloomberg article:

“Campbell, the world’s largest soup maker, DuPont Co., the third-biggest U.S. chemical maker, and United Parcel Service Inc., the world’s largest package-delivery business, are asking workers to help save cash by working smarter with existing technology. A potential cost: Efficiency gains reduce the chances recession-casualty jobs will come back.

“When the productivity growth comes, then watch out because that is when companies start not needing so much labor,†Edmund Phelps, a Columbia University economist and Nobel laureate, said in an interview.

Some 142 non-financial companies in the S&P 500 had improvements in operating margins of three percentage points or more from the final three months of 2007, when the previous expansion peaked, compared with the most recent quarter, according to data compiled by Bloomberg as of yesterday.”

The chart below shows the annualized corporate profits, both before and after taxes since 1947:

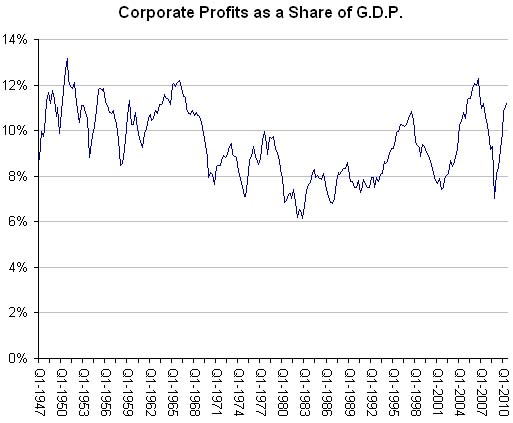

The chart below shows the corporate profit growth in terms of GDP:

It represented 11.2% of G.D.P. last quarter, a figure that has also been growing for seven consecutive quarters. So for the past seven quarters companies have been earning higher profits with almost no hiring of workers since the unemployment remains stubbornly high at around 10%.

Source: The New York Times

The Economist magazine wrote about this dichotomy in the U.S. economy back in August in an article titled “Profits, but no jobs“. From the article:

“AMERICANS used to love to hear tales of success in business. One of the many oddities of the current joyless economic recovery is that this traditional enthusiasm is strikingly lacking. Corporate America has bounced back impressively. The quarterly results season that is now nearly over has revealed that profits are back within a whisker of the all-time highs achieved before the downturn in late 2008. By some calculations, the rate of recovery of profits from their trough is the strongest since the end of the Great Depression.

Yet nobody seems pleased. Not investors, who have failed to push up share prices in the way this sort of earnings growth would have caused them to do at this stage of previous economic cycles. Certainly not politicians, who complain that firms are “hoarding†cash and creating hardly any new jobs. As Robert Reich, an economist at Berkeley and former labour secretary under Bill Clinton, puts it: “Bottom line: higher corporate profits no longer lead to higher employment. We’re witnessing a great decoupling of company profits from jobs.â€

Corporate America is reaping the rewards for tough actions taken after the financial markets collapsed in September 2008.” (emphasis added)

Yes indeed. There is a huge disconnect between rising corporate earnings and job growth. This recovery is not only a “jobless recovery” but also a “joyless recovery”. According to S&P, non-financial companies in the S&P 500 held over $1 Trillions in cash at the end of first quarter. Much of this cash is not getting paid out as higher dividends to investors or being spent on capital investments.

It remains to be unseen how longer this phenomenon of rising corporate profits with no increase in employment numbers can continue.