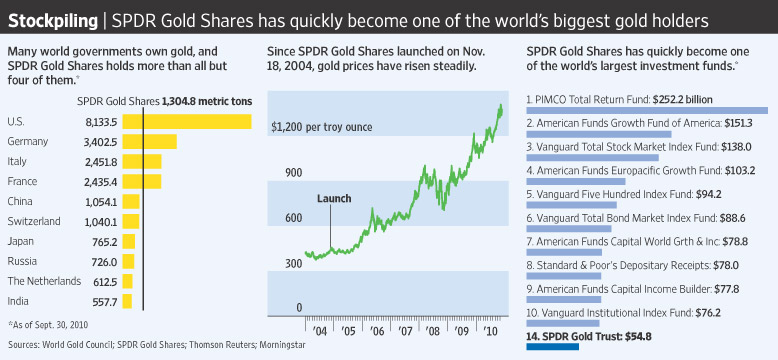

Individual small investors have traditionally avoided investing in commodities since they are extremely volatile. However in recent years Wall Street has made investing them pretty easy via ETFs and other products. Heavy marketing and the crash of equities in the past few years have only attracted more ordinary investors into this sector.One of the commodities that has gone up incredibly in the last few years is gold. From under $500 in 2004 the price of an ounce has gold soared to over $1,300 now. One of the ways investors are playing the gold run is with the SPDR Gold Shares ETF (GLD). The launch of this ETF made gold investing extremely easy for ordinary investors. While this fund continues to attract more funds, some worry that the fund has become too big and that any fall in gold prices may lead to a sharp fall of this ETF.

Individual small investors have traditionally avoided investing in commodities since they are extremely volatile. However in recent years Wall Street has made investing them pretty easy via ETFs and other products. Heavy marketing and the crash of equities in the past few years have only attracted more ordinary investors into this sector.One of the commodities that has gone up incredibly in the last few years is gold. From under $500 in 2004 the price of an ounce has gold soared to over $1,300 now. One of the ways investors are playing the gold run is with the SPDR Gold Shares ETF (GLD). The launch of this ETF made gold investing extremely easy for ordinary investors. While this fund continues to attract more funds, some worry that the fund has become too big and that any fall in gold prices may lead to a sharp fall of this ETF.

The following are some key points about this gold ETF from an article in The Wall Street Journal:

- Lauched in November 2004, the SPDR Gold Shares ETF (GLD) has grown into a $56.7 billion fund in a short span of time.

- Currently this ETF is one of the world’s largest investment funds.

Click to enlarge

Source: Behind Gold’s New Glister: Miners’ Big Bet on a Fund, The Wall Street Journal

- GLD is one of the fastest-growing fund ever and is one of the most active gold traders in the market.

- The fund is buying about $30 million of gold daily for storage in its London vault.

- GLD’s London vault holds about six months’ worth of the world’s entire gold-mining production.

- As a result of buying of gold by this ETF and other gold ETFs some estimate that about $100-$150 has been added to the price of gold.

- This gold-backed ETF holds more gold more than many countries as shown in the chart above.

Despite the tremendous growth of this ETF, ordinary investors may want to be cautious before investing in it at current levels. Speculators are driving the price of gold higher and higher since there is no way to determine the value of this commodity using metrics such as P/E. Despite talks of currency wars and the Fed printing paper money with almost no end in sight, the dollar will remain as currency of choice for the foreseeable future. There are many risks involved with investing in gold in general and especially investing them via ETFs. One of the major disadvantages of investing in the SPDR Gold Shares ETF (GLD) is the treatment of taxes. The I.R.S. levies a long-term capital gains rate of 28% on any gains realized. This rate is much higher than the long-term tax rates on equities which is now set at a maximum of 15%. The long-term capital gains tax rate is applicable to investments held for over one year. The 28% tax rate applies to the sale of arts and other collectibles as well.

From the ETF provider’s website:

“How is GLD treated from a tax standpoint?

The United States Internal Revenue Service (IRS) treats gold as a collectible for long-term capital gains tax purposes. As such, gains recognized by individuals from the sale of SPDR Gold Shares are subject to a capital gains rate of 28% if held for more than one year. This rule extends to all gold held by the Trust. Although there are some restrictions applicable to retirement plans such as IRAs and 401ks investing in collectibles, SPDR Gold Shares received a private letter ruling permitting investment by such retirement plans.”