The U.S. personal savings rate as a percentage of disposable income stood at about 4% at the end of 2009. The last time the savings rate exceeded 10% was in 1984. Compared to most other countries, the US has the lowest personal savings rate in the world.

Household debt as a percentage of GDP and Gross Domestic Savings as a percentage of GDP in China and other countries:

Click to Enlarge

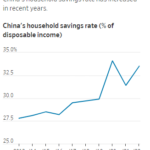

The household debt is the third lowest and the savings rate is the highest in China.The Chinese have traditionally saved a large portion of their household income for the future since social security after retirement is non-existent in China. While high savings rate is good for the country in the long-run, in the short run domestic consumption remains weak as consumers save more their money instead of spending. Since the savings rate is high, it is a challenge for the Chinese government to convert the export-driven economy to domestic consumption based.

Unlike in the US, the concept of borrowing and spending is not readily accepted by most Chinese. Hence the number of credit cards in circulation is still very low in China. Compared to the US market, there were only 186 million credit cards in circulation in China at the end of 2009.This figure is very less since the population of China is much higher than the US and the Chinese middle class alone exceeds the population of the US. The credit card market in China is projected to grow at an annual rate of over 30% over the next four years. As a result of the low penetration rate of credit cards and culture, it is unlikely that increased spending will come from borrowed funds. Instead higher domestic spending will have to come from household savings or incomes.

Overall most Asian countries have lower household debt levels and high savings rates relative to the US and UK.

Still some hedge funds short China and call it a “great credit bubble”:

http://www.insidermonkey.com/blog/2011/01/18/hedge-funds-short-china/