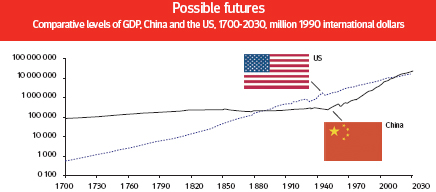

China was the world’s largest economy before 1890. According to Professor Angus Maddison, author of the Chinese Economic Performance in the Long Run, China’s role in the world has changed dramatically in the last thousand years and China is likely to become the world’s largest economy by 2015 beating the US. The author mentioned that China’s economic growth in the next 30 years will not be diminished due to the recent global credit crisis.

The graph below shows the possible futures for the economies of China and the US:

Source:Â Towards a new reserve currency system?, OECD Observer

Chart showing the projected growth of GDP in Developed and Emerging Markets thru 1950:

After the World War II, the US dollar dethroned the British sterling to become the world’s reserve currency. The dollar accounts for about two-thirds of the global reserves and 88% of daily foreign exchange trades.

From the OECD Observer article noted above:

The additional demand for dollars has generated “seigniorage” revenues: in 2008 the US Fed made a net interest income of $43 billion from issuing the currency, which as The Economist newspaper once put it, effectively makes US dollars in global circulation an interest-free loan by the public to the nation’s central bank.”

Empires based on currency rise and fall according to Professor Avinash Persaud. In his 2004 speech titled “When Currency Empires Fall” he noted the following:

“There are good reasons why there is seldom more than one dominant currency. Reserve currencies have the attributes of a natural monopoly or in more modern parlance, a network. If it costs extra to trade with some one who uses a different currency than you, it makes sense for you to use the currency that most other people use, this makes that currency yet bigger and cheaper to use. There is a good analogy with a computer operating system. In that world, Windows is the dollar.

This networking power is why Central banks store dollars in their reserves in a far greater proportion than the proportion of trade with the US. While 30% of international trade is with the US, 70% of central bank reserves are in dollars. It is why most commodities, like oil, copper and coffee are priced in dollars, wherever they are found and whoever they are sold to.

Something else we can be more certain of is that reserve currencies come and go. They don’t last forever. International currencies in the past have included the Chinese Liang and Greek drachma, coined in the fifth century B.C., the silver punch-marked coins of fourth century India, the Roman denari, the Byzantine solidus and Islamic dinar of the middle-ages, the Venetian ducato of the Renaissance, the seventeenth century Dutch guilder and of course, sterling and now the dollar.

A necessary condition of a currency becoming a reserve currency appears to be its breadth of use and cost and ease of transaction, not, as some might think, the ability to hold its value. Clearly hyperinflation would not serve a reserve currency, and the end of reserve currency status is often associated with a cycle of inflation. But within the normal bands of inflation, it is size as a trader that matters. In the long-term, the Swiss franc and yen have been better stores of value than the dollar. Since 1980, they have appreciated by more than 21% and 54% versus the dollar respectively. Yet for much of this time, combined, they have represented no more than 10% of central bank reserves.

In the 18th century Britain was the largest economy of the western world, London was the centre of international trade and finance, the currency was convertible and so sterling became the world’s reserve currency. By the late 19th century, the US had become the world’s largest economy, a position solidified by Europe’s repeated attempt at self-annihilation from the 1880s to the 1940s. By the 1960s, the dollar had usurped sterling and was the world’s new reserve currency with 60% of total central bank reserves being held in dollars, twice the level of sterling reserves.

But time doesn’t stop. By the mid-21st century, the US will no longer be the world’s largest economy. By then, China and India will have overtaken the US, western Europe and Japan, on purchasing power parity terms at least, which should represent where exchange rates are likely to be in the long-run. Indeed optimistic measures of sustainable growth in China and India suggest this will be the case in twenty years time. Ladies and gentlemen, within my life time, the dollar will start to lose its reserve currency status, not to the euro, but to the renminbi.

According to the latest Treasury data, the Chinese hold $ 894.8 billion of US Treasury securities as of December 2009. China is the largest creditor nation in the world while the US is the largest debtor nation. The Chinese renminbi may become the global reserve currency by 2050 since its economy in terms of purchasing power parity is projected to outstrip the US economy. However China has to make its currency fully convertible, remove restrictions on foreign capital entering and leaving the country, accelerate financial reforms before the renminbi can become the world’s currency of choice.

Related:

The Rise of the Renminbi: Will China’s Yuan Become a Global Reserve Currency?, July 23, 2015, Mark Mobius

Good. Now what I need to know is what to do with my USD immediately? I have people hounding me to buy gold, buy silver, exchange into the Real, exchange into the AUD, exchange into the NZD…and I’m at a loss to understand?

Is it not possible to just stop buying from China? (Supply and demand) or is it not possible for a few nations to combine into one currency, trading the USD straight across for a combined currency…(USD, GBP, Deutchmark, CAD?) or some such combo to equal the force of the Renminbi?

Someone help me out here. I am so new to this.

Marcia

Sorry for the delayed reply.Unfortunately I am unable to provide you the answers since I am not an expert in Forex.

However as a general suggestion you may want to spread your USD into other asset classes and diversify. Last year some commodities such as silver, palladium performed very well compared to gold. I don’t think we can just stop buying from China as they are the world’s workshop for things made cheaply. I don’t think it is is possible to combine USD,GBP, etc.