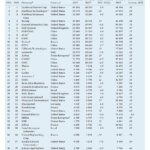

The S&P Agribusiness North America Index consists of 24 largest publicly-traded agribusiness companies that are either Producers, Distributors & Processors and Equipment & Materials Suppliers in this sector.

The Constituents in this Index must meet the following criteria:

- Trade on the U.S. and Canadian exchanges including ADRs

- Have minimum market capitalization of US$ 500M at re-balancing time

- A six-month average daily trading value above US$ 2 million

The Top 10 components in the S&P Agribusiness North America Index are:

1. Bunge Ltd (BG)

Country: USA

Current Dividend Yield: 1.34%

2.Archer-Daniels-Midland Co (ADM)

Country: USA

Current Dividend Yield: 2.00%

3. Potash Corp (POT)

Country: Canada

Current Dividend Yield: 0.35%

4.Monsanto Co (MON)

Country: USA

Current Dividend Yield: 1.36%

5.Syngenta (SYT)

Country: Switzerland

Current Dividend Yield: 2.00%

6. The Mosaic Co (MOS)

Country: USA

Current Dividend Yield: 0.33%

7.Hormel Foods (HRL)

Country: USA

Current Dividend Yield: 2.02%

8.Deere & Co (DE)

Country: USA

Current Dividend Yield: 1.96%

9.Tyson Foods (TSN)

Country: USA

Current Dividend Yield: 0.94%

10. Perdigao SA

Perdiagao and Sadia merged to form BRF Brasil Foods (BRFS)

Country: Brazil

Current Dividend Yield: N/A

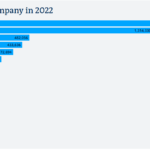

In the U.S., the BLS reported that prices of dairy and related products, fruits and vegetables rose sharply last month contributing to a rise in the food consumer price index. In Asia food price increases are pushing inflation higher.

Chart:

Source: WSJ

Prices of food staples such as rice, milk, and sugar have been rising in recent months. Other food items such as fruits, vegetables and cooking oils have also been increasing in some countries. Countries such as India, China, Thailand and Indonesia are battling with rising food price inflation. With huge populations, India and China are particularly vulnerable if prices escalate further. Agribusiness stocks offers good investment choices for investors now especially since some economists are talking about a double-dip recession. Food stocks tend to offer stable growth and withstand downward pressure in falling markets. While consumers may cut down on discretionary spending, they still have to spend on necessities such as food, utilities, etc.