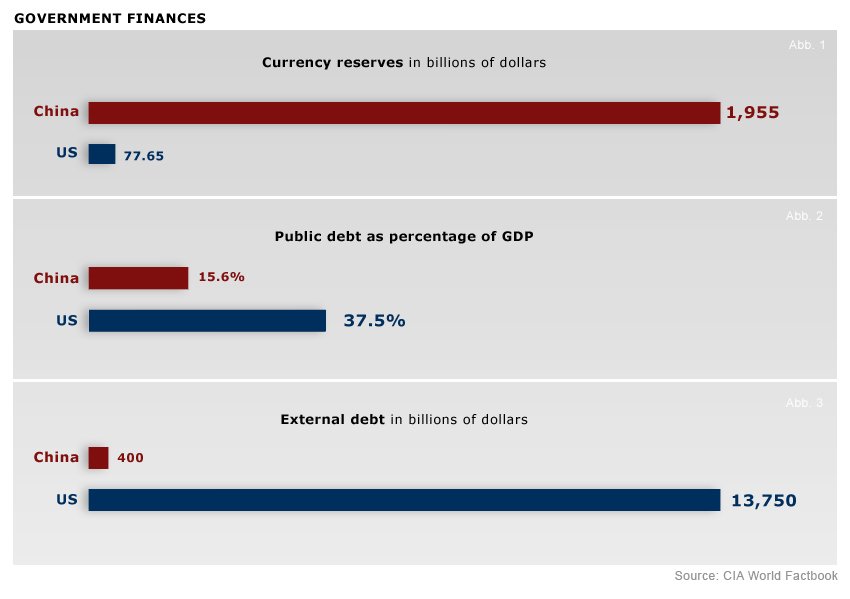

In this post lets take a look at some of the differences between China and USA. The chart below shows the comparison of government finances between the two countries.

Click to enlarge

Source: Der Speigel

China has the world’s largest foreign currency reserves. Though the chart says it is $1.9T, the more recent figure was $2.4 Trilllion at the end of December 2009.

The public debt as a percentage of GDP for the U.S. is more than double that of China at about 38%.

China’s total external debt is just $400B. China is the creditor nation while the U.S. is the debtor nation. Currently the gross external debt of the U.S. is a whopping $13.75 Trillion. According to the U.S. Office of the Treasury the majority of this debt is in the form of long-term bonds and notes.

Clearly the U.S. has long ways to go before it can eliminate the public debts to low levels and be become a creditor nation again.

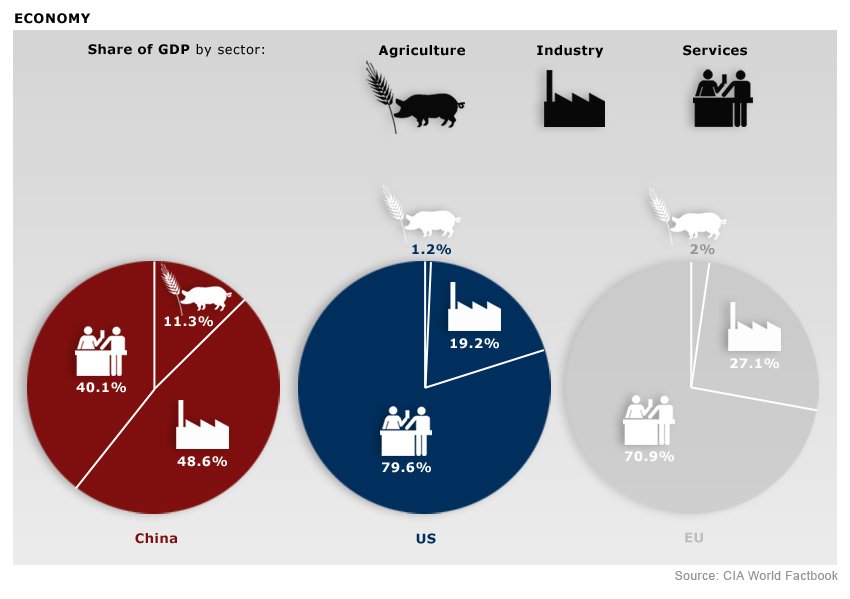

The services sector forms about 80% major part of the U.S. economy whereas in China it is just 40%. Since the majority of the U.S. manufacturing was off-shored to developing countries, this sector accounts for just 19% of the U.S. economy. In China manufacturing accounts for 49% of the economy. A significant portion of the service sector economy in the U.S. was based in the FIRE (Finance, Insurance and Real Estate) industries.Since the credit crisis, the financial and real estate sector have laid off thousands of workers and the industries are still in shaky grounds. For example, it may many years before a meaningful recovery takes place in the real estate industry.

One way for the U.S. to accelerate the economic recovery would be to invest heavily in the manufacturing sector and increase exports.

Related:

China vs. India: Economy and Government Finances

USA vs. UK: Government Finances and Size of Economy

US GDP is $14.2T, China GDP is $4.33T. So China’s manufacturing is $2.1T, and the US is $2.72T. Given the significant delta in population, I don’t think the US is doing so badly.

Chinese Yuan pegging against doller is dangerous for US economy.

China pegging its Yuan againt US dollar that keeps its manufactured product artificially cheap all over the world. It’s a cheating method of trade. It seems like China is intelligent and importing countries are fools.

At present China have some competitor ( like Thailand, Indonesia, Vietnam, etc ) so China selling its product very cheap. Now factories in other countries starts closing because they can’t competate with China ( Unfair trade practice ). So in future, there will not be any competitor for china. That time, China will increase their product cost and sell their goods for heavy profit. For USA it can’t find an alternate for China and can’t open factories immediately. Totally US economy will be spoiled. China became the “ King of the world “.

At present it looks like China is dependent on US import but in future US became slave for Chinese export.

This is the last chance for US to save its own economy from Chinese economic trap.

If Obama afraid and didn’t take any bold action against Yuan pegging, US will be in miserable state.

This is same for all countries which depend on Chinese import like UK, European Union, India & Brazil. They should wake up and put end to this Chinese monopoly trade.

Thalia

I am also of the view that the US is being setup by China. The Chinese are making all the right moves to derail the US economy.

Thanks for your comment.

-David

I think the EU is the worst affected as they are China’s largest trading partner. There needs to be some kind of joint agreement worldwide to put all currency similiar value otherwise our businesses will continue to suffer

I am of the opinion that china is progressing very well and will definately be a big threat to USA in time to come.

Awesome facts, thank you very much.