Some of the large foreign banks are listed as sponsored ADRs on the OTC markets. Though their trading volume is low on a daily basis and are not followed by many analysts, investors can find a few investment opportunities in them. For example, two of the large French banks Societe Generale(OTC:SCGLY) and BNP Paribas(OTC: BNPQY) trade on the OTC markets.

Erste bank(OTC:EBKDY) of Austria received a government bailout in 2008 by issuing non-voting securities which were non-dilutive to existing shareholders. The bank followed that by raising additional capital last year to shore up its balance sheet.Last year Erste bank shares rallied strongly from a low $4 to reach about $19. Despite this increase, the stock holds upside potential as all the bad news is already priced in and the bank has a strong franchise in Austria and Central and Eastern Europe. As of September,2009 the Tier 1 ratio stood at 8.3% above the minimum requirement of 8%. Unlike its competitor Raiffeisen, it does not have heavy exposure to the former Soviet republics such as Ukraine. However a few Austrian banks are still suffering from losses to their exposure to Eastern Europe. Last month Austria nationalized Hypo Group Alpe Adria, its sixth-biggest lender due to heavy losses in Eastern Europe.

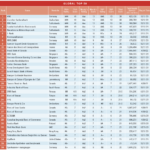

The complete list of foreign bank stocks listed on the OTC markets:

[TABLE=282]

Singapore banks United Overseas Bank(OTC:UOVEY) and DBS Holdings(OTC:DBSDY) remained strong during the credit crisis and rebounded well last year. UOB’s Tier 1 Capital Adequacy ratio was 13.5% at the end September 2009. DBS Holdings continues to expand in emerging Asian countries. The Tier 1 Capital Adequacy ratio stood at 12.5% as of 3rd quarter,2009.