Last month we reviewed the Tier 1 Capital Ratios of Large US Banks. Most of them had Tier1 ratios in the 10% range based on data from first quarter. Today lets take a look at the Tier1 Ratio of large European banks.

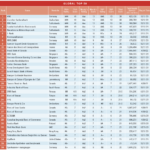

[TABLE=170]

Note: The data shown above are the latest available from the company sites. They may be end of 2008 or Q1,2009 earnings report. They are known be accurate but do your own research before making investment decisions

One of the ratios that can be used to identify the strength of a bank is the Tier1 Capital Ratio. Unlike other ratios, Tier1 is the most commonly published ratios by many banks of the world.

Despite government infusions of billions of pounds, British banks still have Tier1 ratios under 10%. While Erste bank(EBKDY) of Austria has high East European exposure, the bank received a 2.7 B euro capital infusion from the government. The deal was favorable to Erste because it sold the government non-voting securities, redeemable after five years, on an 8.0% rate of interest. The shares were also non-dilutive to existing shareholders. Erste must have to increase its Tier1 capital ratio higher from the current 7.20%. The Swiss, German, Greek and Government Bank of Ireland(IRE) are stronger with relatively high Tier1 ratios.