This week the Organisation for Economic Co-Operation and Development (OECD) released the OECD Private Pensions Outlook 2008 report. This report analyzes the private pension systems in various countries and compares their performance in terms of fees, risk allocation, etc.

One of my key observations in this report is that the pension funds in the USA increased their equity allocations between 2001 and 2007 to over 60% of the total assets they managed. Since the markets fell heavily 2008, they were exposed to large losses. Other developed country pension funds that increased equity allocations were Ireland, Norway, Portugal, etc.

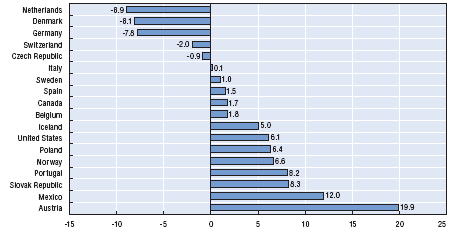

Chart – Differences in Equity Allocations between 2001 and 2007 in select OECD countries:

Source: OECD

As we can see from the above chart, Germany, Denmark, The Netherlands and Switzerland reduced their equity allocations in the same period. The report says: “In the case of Denmark and the Netherlands this portfolio reallocation appears to be partly driven by the introduction of stricter, risk-based funding requirements.”

Last year by October end, total losses in private pension plans in developed countries were USD 5 Trillion. Out of that USD 3.3 Trillion were in the US alone (Source: OECD). In 2008, about $7 Trillion shareholder wealth was lost in the US as per the New York Times.

Year 2008 in Numbers Graph from The New York Times:

(Click to enlarge)

US investors have to monitor their pension funds’ performance more closely this year as they have raised their equity allocations in 2008.

The S&P is down 8.46% year-to-date and the financials are down an incredible 30.10%. Ans we still have ten and half months to go. Faced with huge losses some investors have cut down their investments in the equity markets. Companies such as FedEx,Eastman Kodak, Motorola, General Motors and Resorts International have also cut their 401K matching contributions to save cash. Hence if the economy does not respond to the stimulus plans of the Obama administration then it is highly likely that US pension funds will have negative returns this year on top of losses incurred last year.